Despite Covid, Brexit and the Russia-Ukraine war, climate change is fast-becoming the central issue facing UK, European and global agriculture – as the recent record temperatures attest. The challenge with Greenhouse Gas (GHG) emissions is especially prevalent in grazing livestock. A recent White Paper by farm business consultancy, Andersons, has found that whilst there are notable imperfections with the methodologies used to quantify GHG emissions on farms, particularly methane, this is not an excuse for inaction.

The white paper’s finds that although the current tools and methodologies used to calculate GHG emissions are not perfect, improvement against an imperfect measure is still progress – which is urgently needed. The farming industry needs to avoid fixating on the details of the calculation methods and focus more on making the changes necessary to reduce emissions. Society expects agriculture to play its part and the industry will be judged on improvements made.

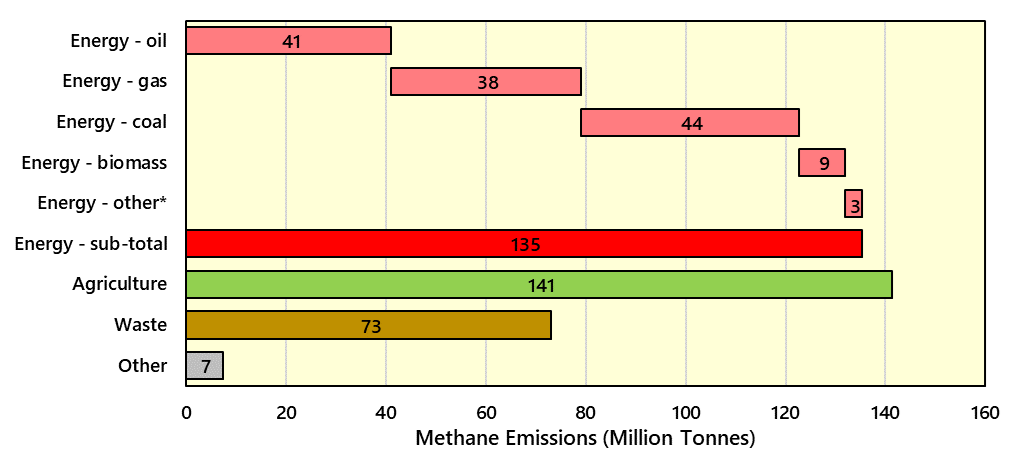

That said, there are strong grounds for methane to be treated separately as a GHG. Even within methane, clear distinctions are needed between methane from enteric fermentation (livestock) and methane emitted from fossil fuels. The former is recycled, if livestock populations and feeding methods remain largely the same over time. The latter is ‘new’ methane which has a much more potent impact, especially as methane production from energy (38%) accounts for a similar share of global output as agricultural methane (40%). Waste has a 20% share, much of this is food waste and needs reducing with urgency.

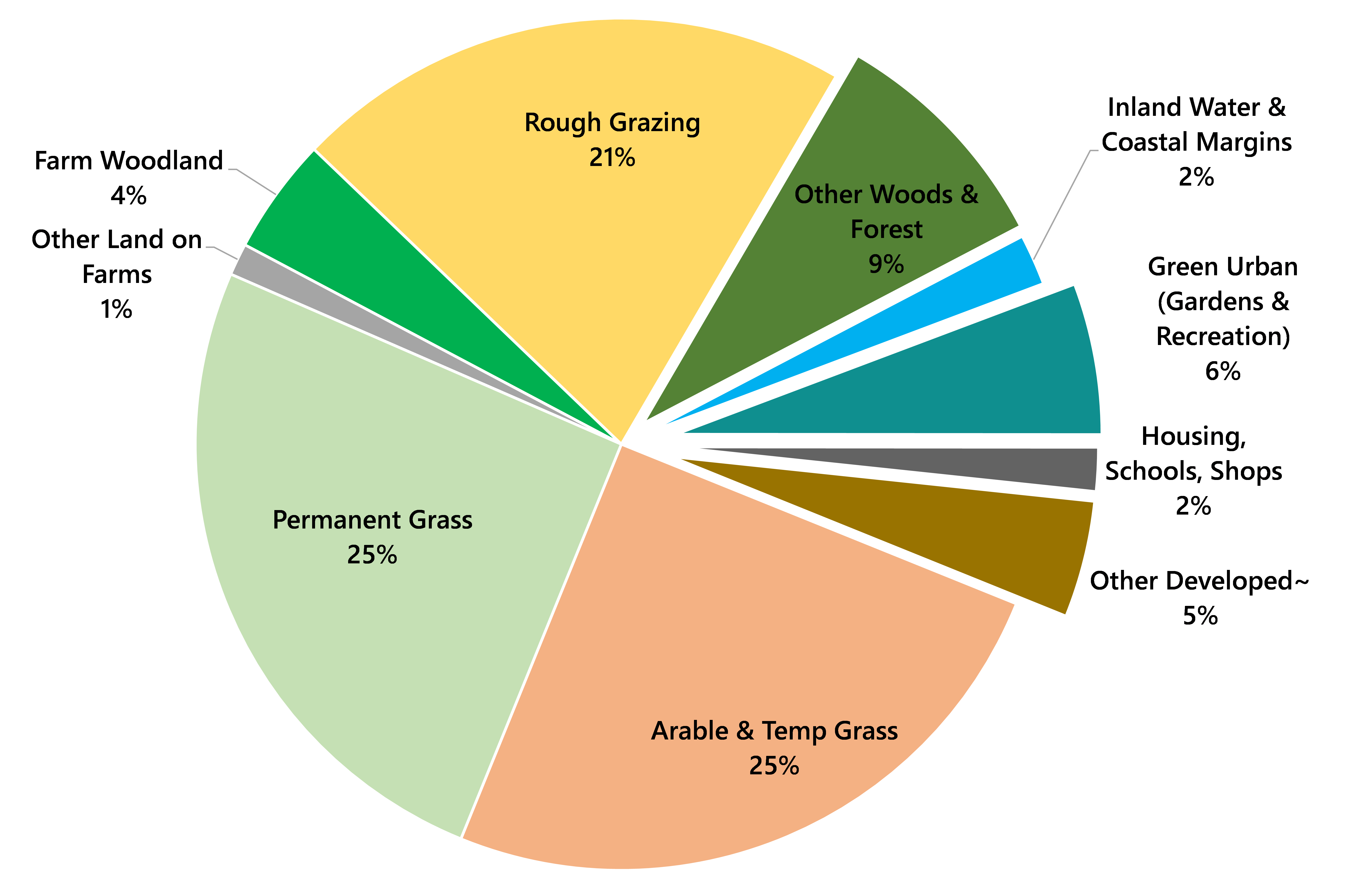

Estimated Global Methane Emissions by Source

Source: International Energy Agency (IEA), analysed by Andersons

For farmers, ‘doing the right thing’ environmentally can also help to improve productivity. These ‘win-wins’ (e.g., reducing inorganic nitrogen fertiliser) need to be deployed widely and urgently. Yet, this will only get farming so far.

To get to Net Zero a step-change in practices is needed, as are financial incentives for farmers to reduce net GHG emissions, particularly by sequestering carbon. Some farmers are adopting a wait-and-see attitude until there are clear commercial opportunities. Whilst many farmers want to do-the-right-thing, businesses need to be sustainable both environmentally and financially.

From a policy-making perspective, concerns with GHG emissions are rightly a core policy-making focus. Yet, it is vital that progress in this area does not lead to carbon leaking and environmental degradation elsewhere. Future policy requires a balanced approach across these issues.

Across the UK and Europe, emission targets are now in place. Whilst more work is required in terms of plans and strategies, the key now is effective action. Without this, the best plans and targets become, yet another, source of waste. There is much to be done and farmers are central to the solution. Andersons White Paper can be accessed by clicking here.

GHG emissions and the environment is a key topic within the forthcoming 53rd Edition of the John Nix Pocketbook for Farm Management, publishing in early September. It includes a detailed overview of emissions in agriculture and food production with additional information on ammonia emissions, food waste and an updated section on carbon markets in UK farming. Also, there is a wide array of detail on topics such as conservation costs, renewable energy, and fuel usage.

The 53rd Edition is updated for 2023 with over 100 enterprises costed for the year ahead, overheads, capital and other farming costs. It recognises that farming will continue; however challenging the coming months and years turn out to be, and farmers and managers must continue to focus on what they have control over within their farming systems.

The Farm Management Pocketbook is designed to help farmers, students, and other agribusiness professionals to understand their farms, the industry, and the opportunities that it offers. It costs £32.00 +P&P. Visit https://theandersonscentre.co.uk/shop/john-nix-pocketbook/ to pre-order a copy, for delivery in early September.

Ends.

Notes:

No. of Words: 627

Authors: James Webster and Michael Haverty

Date: 17th August 2022

This news release has been sent from The Andersons Centre, 3rd Floor, The Tower, Pera Office Park, Melton Mowbray, Leicestershire LE13 0PB. For further information please contact James Webster (M: 07707 088409) or Michael Haverty (M:07900 907 902).