Defra’s budget is to be cut in real-terms over the next three years. This is the headline result of the long-awaited Comprehensive Spending Review (CSR).

The Department’s ‘Resource’ spending (i.e. day-to-day expenditure) is to fall by an annual average of 2.7% between the current year, 2025/26, and the 2028/29 financial year. Capital spending, which, in Defra’s case, mainly goes on flood defences, does slightly better; falling by an annual average of 1.8% over the same period. Defra is one of the Departments with the largest cuts in real-terms funding.

Farming Budget

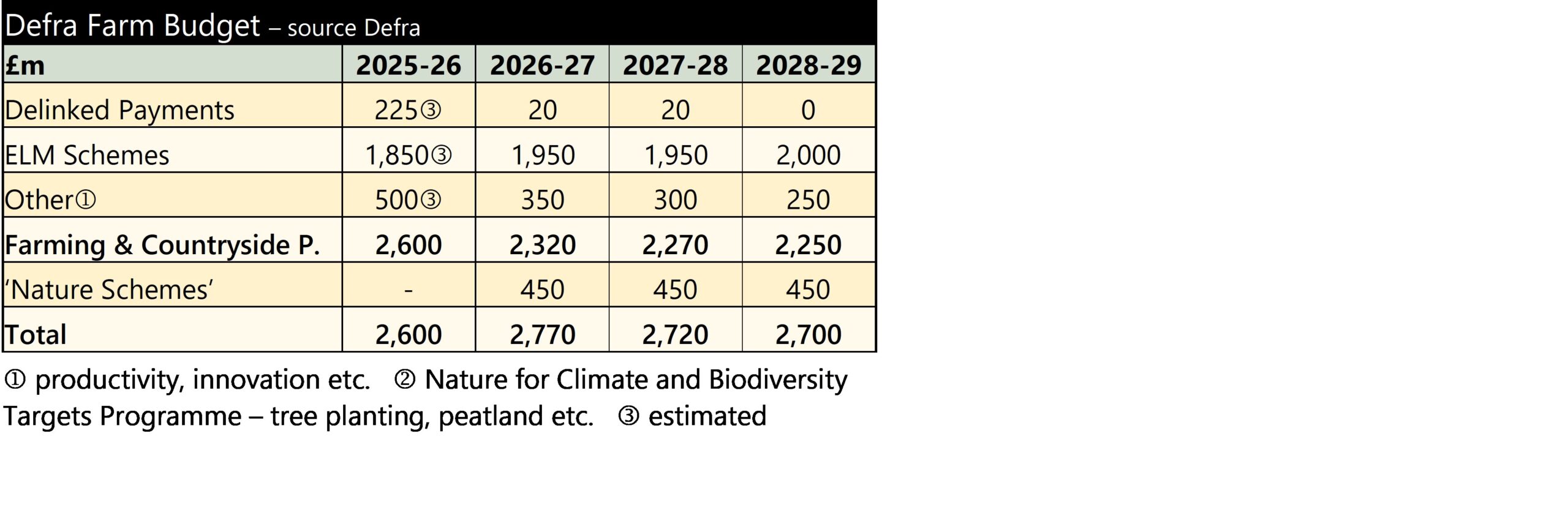

Farmers are likely to be most worried about the agricultural support budget. The Farming and Countryside Programme (FCP) is the equivalent of the spending that used to be received under the Common Agricultural Policy. The Review sets out that an average of £2.3bn will be paid under the FCP over the next three years. This compares with £2.4bn budgeted for 2024/25 and £2.6bn this year (although the current year is being boosted by underspends from previous years). All of these figures are at current prices so do not account for inflation. Effectively, the Government has done what previous administrations, and the EU, have done for many years, and just rolled-over the existing funding, but not uprated it for inflation. Assuming 2.5% inflation for the next two years, and with the drop from £2.6bn this year, to £2.3bn in 2028/29, this results in around an 18% real-terms reduction. Even being generous and using £2.4bn as the starting point, it is still an 11% real-terms cut.

These cuts will be translated into the budgets for Wales, Scotland and Northern Ireland through the Barnett formula.

A subsequent Blog post on the Defra website (see https://defrafarming.blog.gov.uk/2025/06/16/spending-review-2025-a-commitment-to-farming/ ) provided a bit more detail on the breakdown of spending. The table below summarises this. We have put the current year’s spending in for comparison – although the breakdown in the Farming and Countryside Programme (FCP) for this year is not known – so they are our estimates. The figures are all in current prices – so take no account of inflation.

It can be seen that the budget for the FCP falls significantly in current terms compared to the current year. It is the rather nebulous ‘Nature Schemes’ that brings the figure back up.

Nature Schemes

The Blog post states that the ‘Nature for Climate Fund’ and the ‘Biodiversity Targets Programme’ will be ‘worth up to £400m per year‘. Firstly, this figure is somewhat less than the £450m p.a. allocated to ‘Nature Schemes’ in the overall budget (it’s not clear why – some other schemes may be included). Secondly, the two words ‘up to’ in the statement seem to provide significant wiggle-room for Defra. Lastly, it is unclear what these schemes (and any other Nature Schemes) will fund. The Defra article refers to tree-planting and (rewetting) peatlands. Whilst these grants may be open to landowners and farmers it is a stretch to consider them ‘farming support’ as these uses suggest the land mostly, or wholly, coming out of productive agriculture.

BPS and ELM

It is stated that the BPS (aka ‘delinked payments) will continue for 2026-27 and 2027-28. However, all reference amounts up to £30,000 will be reduced by 98%(!), with nothing paid on amounts above this. Therefore, the maximum any business will get in 2026 and 2027 is £600.

Defra promises ‘more details later this summer’ on how future ELM schemes will work. Defra has stated an aspiration to make the schemes simpler.

Probably the best thing that can be said about the Budget settlement is that ‘it could have been worse’. However, the pressure on Defra spending looks set to remain. This has implications for ELM schemes. As we have written previously, it is highly unlikely that the SFI, when it returns in 2026, will look much like the scheme just closed. It may well not be open to all farms (being targeted on certain locations or farm sizes). The options are likely to alter too as Defra looks for value-for-money in its reduced circumstances.

If you found this article useful, there are numerous additional articles published each month on our Professional Update bulletin service. You can access a no obligation 90-day free trial via the link below.

Sign up to the Professional Update

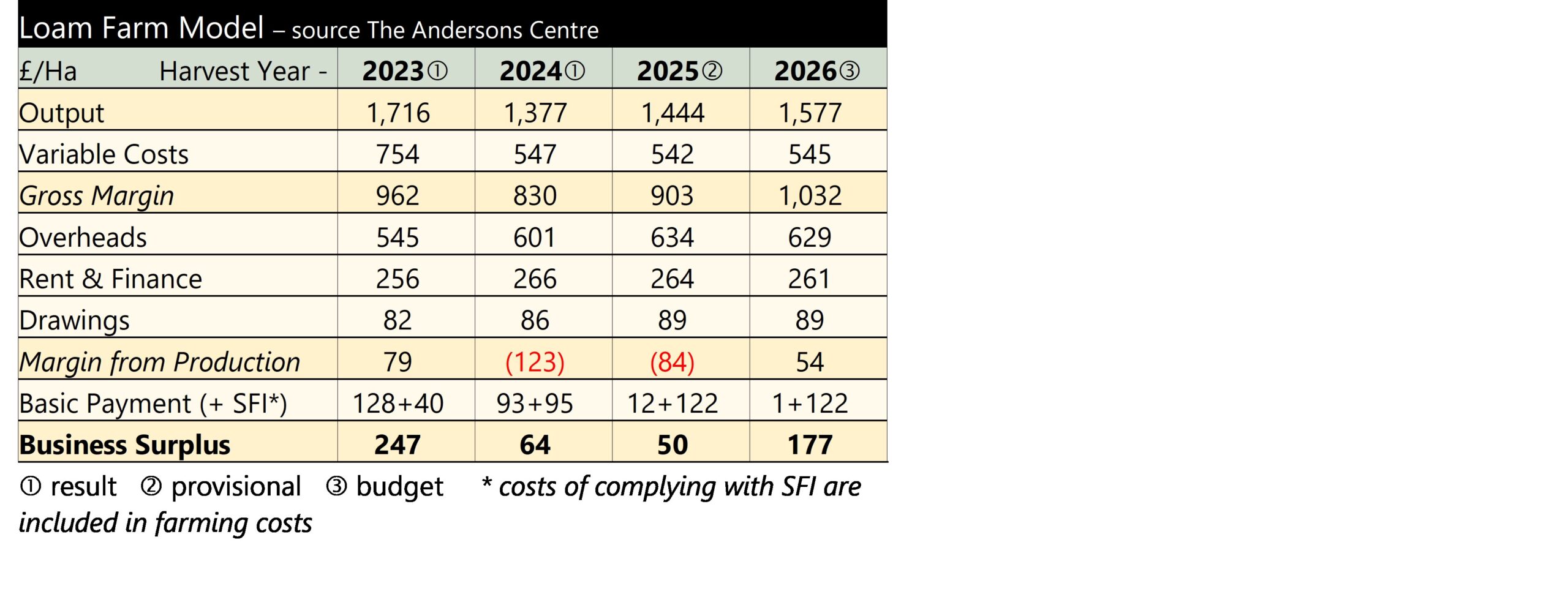

The 2023 year was reasonable – although it looked poor at the time, in comparison with the two spectacular years that preceded it. Harvest 2024 suffered from the very wet autumn 2023 through into spring 2024 reducing yields. Grain prices were also lower than in the previous year. This meant the farm made a loss from production last year and required the BPS and SFI to bring it back into surplus. For the current year the weather has presented the opposite problem – it has been too dry through the spring. This is forecast to result in yields again being lower than the farm’s average. Prices have not improved since last year either. It can also be seen that overhead cost continue to push up. Overall, the Margin from Production is still negative, although slightly better than last year. However, there has been a big drop in the BPS with the maximum £7,200 being received in 2025 equating to just £12 per Ha on Loam Farm. SFI payments have increased a little as the farm ‘upgraded’ its agreement by going for some extra SFI 2024 options. The overall Business Surplus is set to be lower than last year.

The 2023 year was reasonable – although it looked poor at the time, in comparison with the two spectacular years that preceded it. Harvest 2024 suffered from the very wet autumn 2023 through into spring 2024 reducing yields. Grain prices were also lower than in the previous year. This meant the farm made a loss from production last year and required the BPS and SFI to bring it back into surplus. For the current year the weather has presented the opposite problem – it has been too dry through the spring. This is forecast to result in yields again being lower than the farm’s average. Prices have not improved since last year either. It can also be seen that overhead cost continue to push up. Overall, the Margin from Production is still negative, although slightly better than last year. However, there has been a big drop in the BPS with the maximum £7,200 being received in 2025 equating to just £12 per Ha on Loam Farm. SFI payments have increased a little as the farm ‘upgraded’ its agreement by going for some extra SFI 2024 options. The overall Business Surplus is set to be lower than last year.

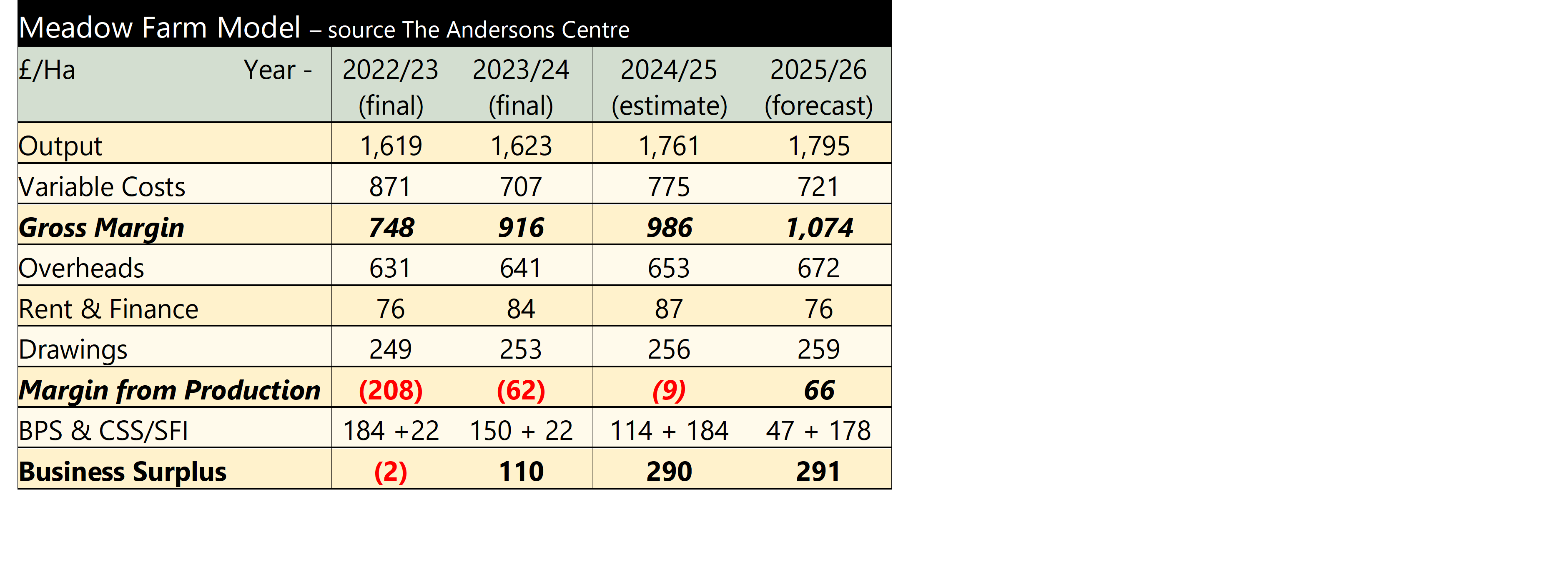

The 2024/25 year, just finishing, shows an improvement in output once more. Meadow Farm sells its finished stock in the autumn, so will not have experienced the significant rise in cattle prices since the turn of the year. Some of the higher variable costs are due to the farm entering the SFI (i.e. herbal ley establishment). The extra income from the SFI offsets the decline of the BPS and the business profitability improves.

The 2024/25 year, just finishing, shows an improvement in output once more. Meadow Farm sells its finished stock in the autumn, so will not have experienced the significant rise in cattle prices since the turn of the year. Some of the higher variable costs are due to the farm entering the SFI (i.e. herbal ley establishment). The extra income from the SFI offsets the decline of the BPS and the business profitability improves.