Surging Costs Causing Serious Concern

Even before the conflict in Ukraine, inflation had become a hot topic both in the general economy and in farming. Events since the 24th of February have exacerbated the inflationary pressures, particularly at the farm-gate level, and will cause input costs to rise sharply in the year ahead. This is one of the key messages from the recent Andersons Spring Seminars.

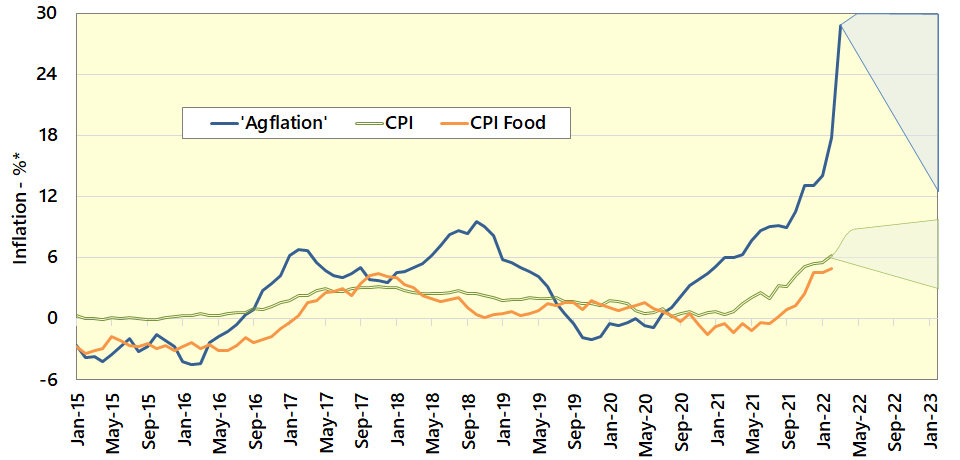

Andersons’ Agflation index builds upon on Defra price indices for agricultural inputs and weights each input cost (e.g., animal feed) by the overall spend by UK farmers. Andersons then provides a more up-to-date estimate of the price index for each input cost category; the March 2022 estimates are now available. Agflation is currently running at 28.8% per annum, dwarfing the UK Government’s Consumer Price Index (CPI) which itself has accelerated to 6.2% in February.

Andersons ‘Agflation’ and Consumer Prices Index (CPI) – 2015 to 2023

Sources: ONS and Andersons

Note: * represents the % change versus the same month a year earlier.

Andersons’ Agflation index is much more variable than general inflation. This is due to the linkages to commodity prices for such things as fuel, fertiliser, and animal feed (feed is almost a quarter of the index). Whilst Agflation surged to nearly 30% in March 2022 (versus March 2021), it had been at 10% even before the invasion of Ukraine. Given recent developments, it is likely to remain high for the rest of 2022 at least.

The value of ammonium nitrate has exceeded £900 per tonne, up from £645 per tonne in January. The value of tractor fuel has also risen substantially. In 2021, the price of red diesel averaged almost 66 pence per litre according to the AHDB. Whilst price discovery for inputs is challenging presently, with terms changing frequently, red diesel prices have been quoted by some publications in excess of 130 pence per litre. Russia’s importance in energy markets, especially natural gas and crude oil, will pose significant challenges for the industries relying on these commodities. Natural gas is a key input into ammonium nitrate production and fertiliser prices will remain elevated as a result.

At the farm-level, the high cost of inputs will challenge many businesses in the next 12 months and beyond. The working capital of farms will be under serious pressure. While output prices have risen in some sectors (e.g., cereals), these have of course, created additional pressure on feed costs in the livestock sectors. Across all sectors, the level of cash required to operate has also been increasing considerably.

These issues were examined during Andersons Spring Seminars and an Online version is now available. Andersons Online Seminars contain a full recording of the Spring Seminar held at Harper Adams University in March. It covers the Russia-Ukraine conflict and a range of other issues affecting the profitability of UK agriculture (including policy reform and land use change) in greater detail. To learn more and access your copy today, please go to https://theandersonscentre.co.uk/shop/andersons-2022-seminar-online/

Ends.

Notes:

No. of Words: 497

Author: Michael Haverty

Date: 7th April 2022

This news release has been sent from The Andersons Centre, 3rd Floor, The Tower, Pera Office Park, Melton Mowbray, Leicestershire LE13 0PB. For further information please contact Michael Haverty on +44 (0)7900 907 902.