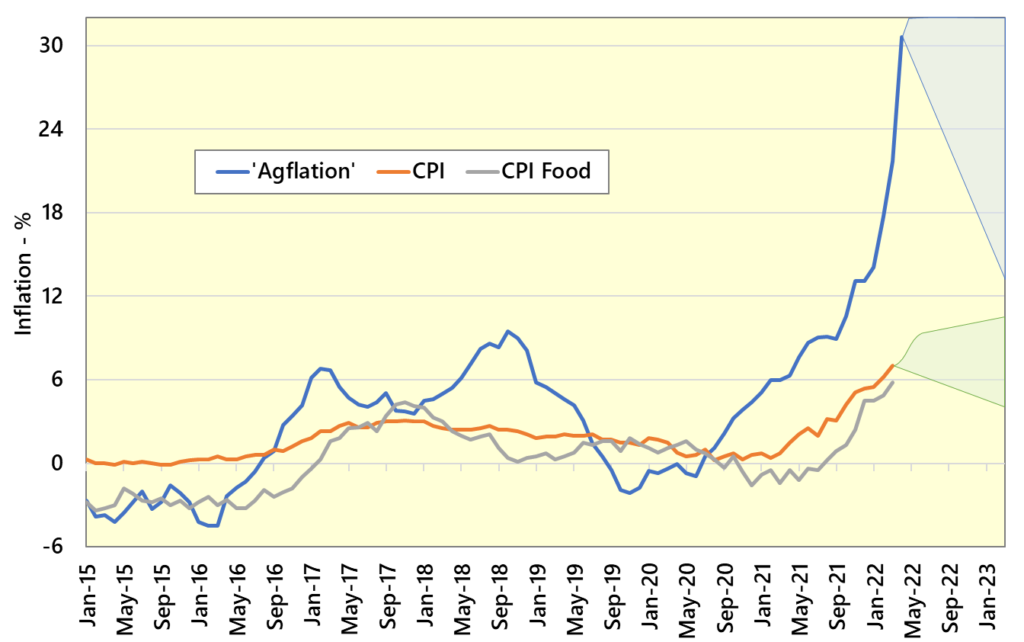

Since the turn of the year UK ‘Agflation’ has been soaring driven by primarily by the Russia-Ukraine conflict. The latest estimates for April shows that it now stands at 30.6% – levels not seen in decades. All the while, general inflation, as measured by the consumer prices index (CPI) and food prices (CPI Food) have been rising at a much slower rate (circa 6%). This means that many farm businesses are now feeling a severe squeeze on margins and this is set to continue for the foreseeable future.

Andersons ‘Agflation’ and UK Consumer Prices Index (CPI) – 2015 to 2023

Sources: ONS and Andersons

Notes: Andersons’ Agflation index builds upon on Defra price indices for agricultural inputs and weights each input cost (e.g., animal feed) by the overall spend by UK farmers. Andersons then provides a more up-to-date estimate of the price index for each input cost category.

* represents the % change versus the same month a year earlier.

The Russia-Ukraine conflict has had most effect on feed, fuel, and fertiliser prices. However, as these underpin most agricultural inputs in some form, cost increases are also showing elsewhere (e.g., contracting costs, crop protection products and building materials).

Several livestock sectors are showing signs of stress. The pressure is most pronounced in the pig and poultry sectors where feed traditionally accounts for 65-80% of production cost. Dairying and grazing livestock are also feeling the strain, particularly for those farms that have not bought forward their fertiliser.

The arable sector is less affected for 2022 as most farmers have bought forward their fertiliser and output prices have hit record levels recently (contributing to the feed cost rises mentioned above). For many farmers in this position, 2022 is shaping up to be a stellar year – the value of the unharvested wheat crop has risen by more than 50% since it went in the ground. That said, significant challenges loom for 2023. High input costs and taxation on 2022 profits will stretch working capital requirements.

These severe inflationary pressures are happening at a time when all farms in England will be facing cuts in BPS payments, which will reach 35% during 2023.

Without significant price increases to cover elevated production costs, many farms will struggle. In such times, it is especially crucial to demonstrate competent cost management, particularly for farm advisors which many farm businesses are depending on to steer them through the current crisis.

The Agricultural Budgeting and Costing Book contains all the farm and rural business information you need in one publication. It is concise, clear, and easy-to-use. The information is updated every six months, so you are always using the most relevant data, something which is especially vital during inflationary periods.

The contents include;

- Fully updated gross margins for all farming sectors, crops, and livestock, including net margins for key enterprises.

- Sensitivity analysis and discussion of market prospects.

- The widest range of information on alternative enterprises, diversification, and non-farming income sources available in any UK publication.

- Explanation of the support systems and grants across GB, including BPS rules and rural grants. An outline of post-Brexit farm policy.

- Farming costs including forage, feed, fertiliser, and pesticides.

- Overhead cost data covering machinery, labour, contracting, building costs, and rents.

- An overview of taxation and the legislation affecting agriculture.

- A vast array of general reference information for the farming sector.

For nearly 50 years, The Agricultural Budgeting and Costing Book has been providing industry leading farm management and costings information to agricultural advisors across the UK and is the leading publication of its kind in the industry. The 94th Edition, or an annual subscription (2 editions) can be ordered via The Andersons Centre website – https://theandersonscentre.co.uk/shop/

Ends.

Notes:

No. of Words: 619

Author: Michael Haverty

Date: 16th May 2022

This news release has been sent from The Andersons Centre, 3rd Floor, The Tower, Pera Office Park, Melton Mowbray, Leicestershire LE13 0PB. For further information please contact Michael Haverty on +44 (0)7900 907 902.