Defra has released further information on the Sustainable Farming Incentive (SFI) for 2022. It is now expected to open for applications in June and then remain open with no closing date. This is to allow those interested to apply at a time to suit. However, Defra has stated that, if it is necessary to close applications, it will give six weeks’ notice. The information is included in a ‘collection’ of webpages which can be found at https://www.gov.uk/government/collections/sustainable-farming-incentive-guidance.

Below is a summary of the key points:

- Agreements will be for three years. Initially it will only be open those businesses which are eligible for the BPS – the business (SBI) must have at least 5 Ha of eligible land and 5 or more BPS entitlements on 16th May 2022 – but there is no requirement to have made a claim.

- The applicant must have ‘management’ control of the land for three years e.g. own the land or have a tenancy over it

- Payment will be made quarterly in arrears i.e. the first payment will be made three months after the agreement commences

- The Standards will not include funding for capital items in 2022. But it is possible to apply for existing funding for capital items for parcels included in an agreement, such as Countryside Stewardship capital grants.

- In the future, SFI will include capital items funding to help complete the actions in the standards

- Applications will be online via the Rural Payments Service. Prospective applicants are encouraged to ensure their digital maps are up-to-date, including land cover (certain land covers will be eligible for each standard) and available area. With the application window opening after BPS, in most cases these should already have been checked

- Certain changes can be requested to an agreement. It will be possible to upgrade an agreement annually to:

- add more Standards as they become available

- add more land, including land coming out of Countryside Stewardship

- increase Levels within Standards already in an SFI agreement

- it will not be possible to reduce the Levels or land area, except under very limited and specific circumstances

- it will not usually be possible to transfer an SFI agreement to another person

- You do not need to have an SFI Standards agreement to be eligible to apply for the SFI Annual Health and Welfare Review.

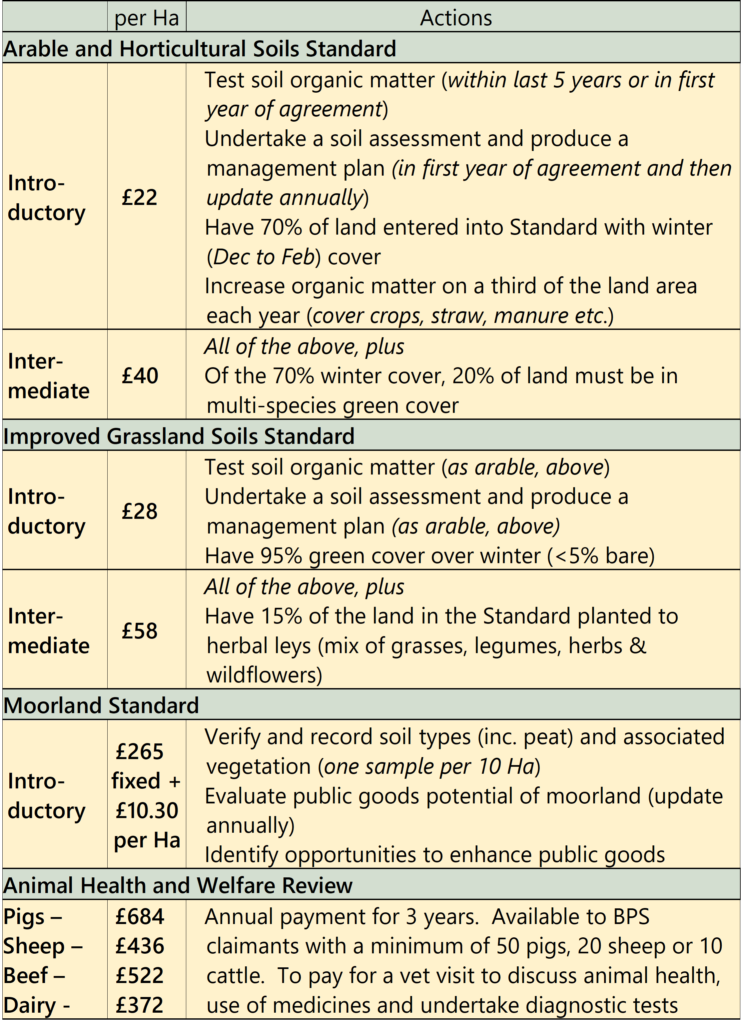

Below is a summary of payments. The Moorland Standard payment has been increased, fairly significantly, since the previous announcements. Those with common land entered into an SFI agreement will receive an additional £6.15 per Ha. Payments for the other standards, remain the same:

Sustainable Farming Incentive (SFI) 2022

Source: Defra (as at March 2022)