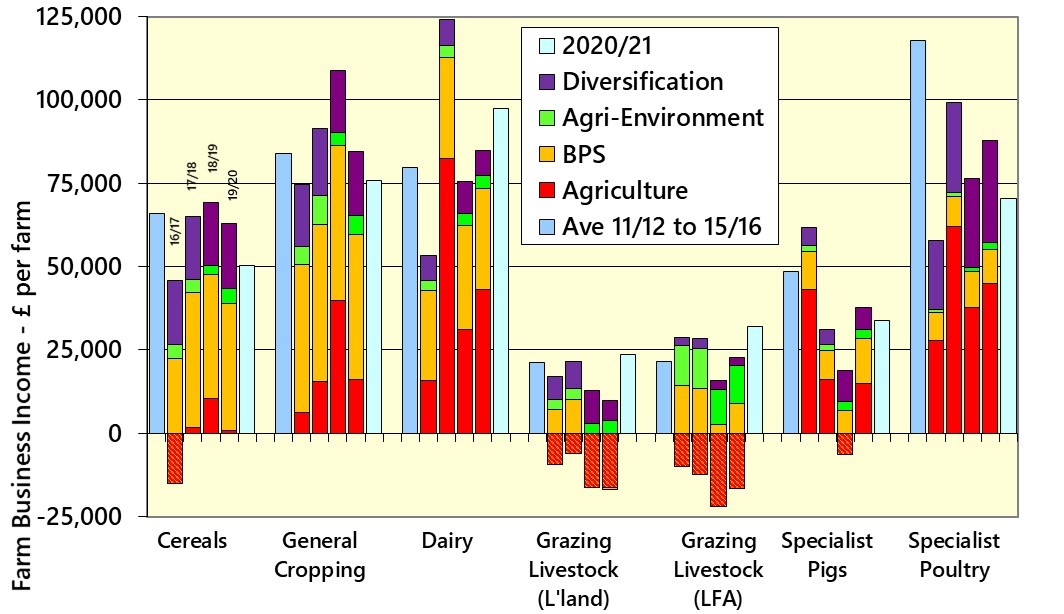

Defra has released its revised Farm Business Income (FBI) figures for 2019/20. Taken from the English Farm Business Survey (FBS), the data shows FBI for various standard farm types. FBI can be thought of as equivalent to the ‘Net Profit’ measure widely used in accountancy. These results update the provisional ones released earlier in the year. The FBS works on Feb/March year ends so the period being reported covers harvest 2019 and the 2019 BPS. The full release can be found at https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/944352/fbs-businessincome-statsnotice-16dec20.pdf In the chart below, the first column for each sector shows the average FBI from 2011/12 to 2015/16. The next four columns show the FBI for the subsequent years, broken down into four ‘profit centres’. The final, light blue column is Andersons’ estimate for the current 2020/21 year. As can be seen, only Dairy, LFA Grazing and Specialist Pigs and Poultry farms saw an increase in returns in 2019/20 compared to the year before.

Source:Defra

When looking at the breakdown of where the profit comes from for the years 2016/17 to 2019/20, red is profit from farming, orange represents the returns from the BPS, green is agri-environment scheme profit, and purple represents diversification. For all the land based enterprises (Cereals, General Cropping, Dairy and Grazing Livestock) it can clearly be seen what a high percentage of profit currently comes from the BPS. For the two Grazing Livestock farm types the return from agriculture is consistently negative; it takes part (or all) of the Basic Payment to return these farms to profit. This is of real concern when looking ahead to the removal of direct support which is commencing this year. Of course, FBI is only an average for the sector. The range in performance across farms is vast, and the more efficient units are likely to have made a much better return than these average values show. Unfortunately, the opposite is also true.

Have you got a plan to ensure your farm business will remain profitable as the BPS reduces over the next seven years? Or do you need help and advice on what may be available, whether that is through capital investment to improve the productivity on your farm or are you looking to replace some of the ‘lost’ BPS money by entering into a Countryside Stewardship or ELM agreement. All our consultants have access to the most up-to-date information on all the future schemes and are experienced in making good quality applications. If you would like some advice please contact your usual consultant, or the office on 01664 503200 or email [email protected].

Finally, we have made some initial estimates of 2020/21 FBI, shown in light blue on the chart. These show the Grazing Livestock farm types seeing significant improvement mainly due to the better livestock prices experienced since spring 2020, but these are from a pretty low base. Dairy farms are also forecast to see a further increase on the back of solid milk prices and a decline in costs. Lower cereal and other crop output from harvest 2020 are forecast to impact on Cereal and General Cropping farm profits.

If you are interested in getting a concise and unbiased commentary on the key issues affecting business performance in the UK agri-food industry, click on the link below for a 90-day free trial of Andersons’ AgriBrief Bulletin: