World politics have been balancing on a knife edge throughout February. On the morning of 24th February 2022, that balance was firmly tipped. Russia’s invasion of Ukraine represents the biggest political shock to markets in a long time. The ramification for world agricultural markets is significant.

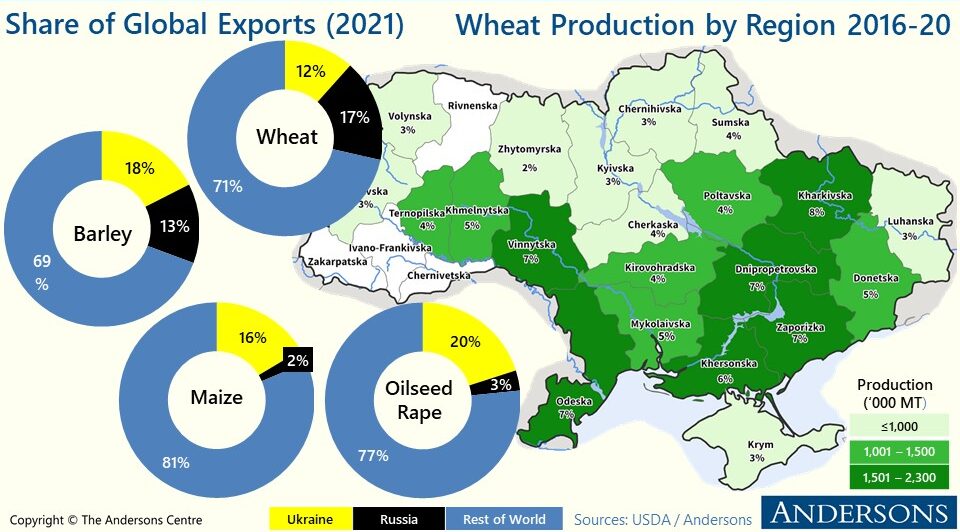

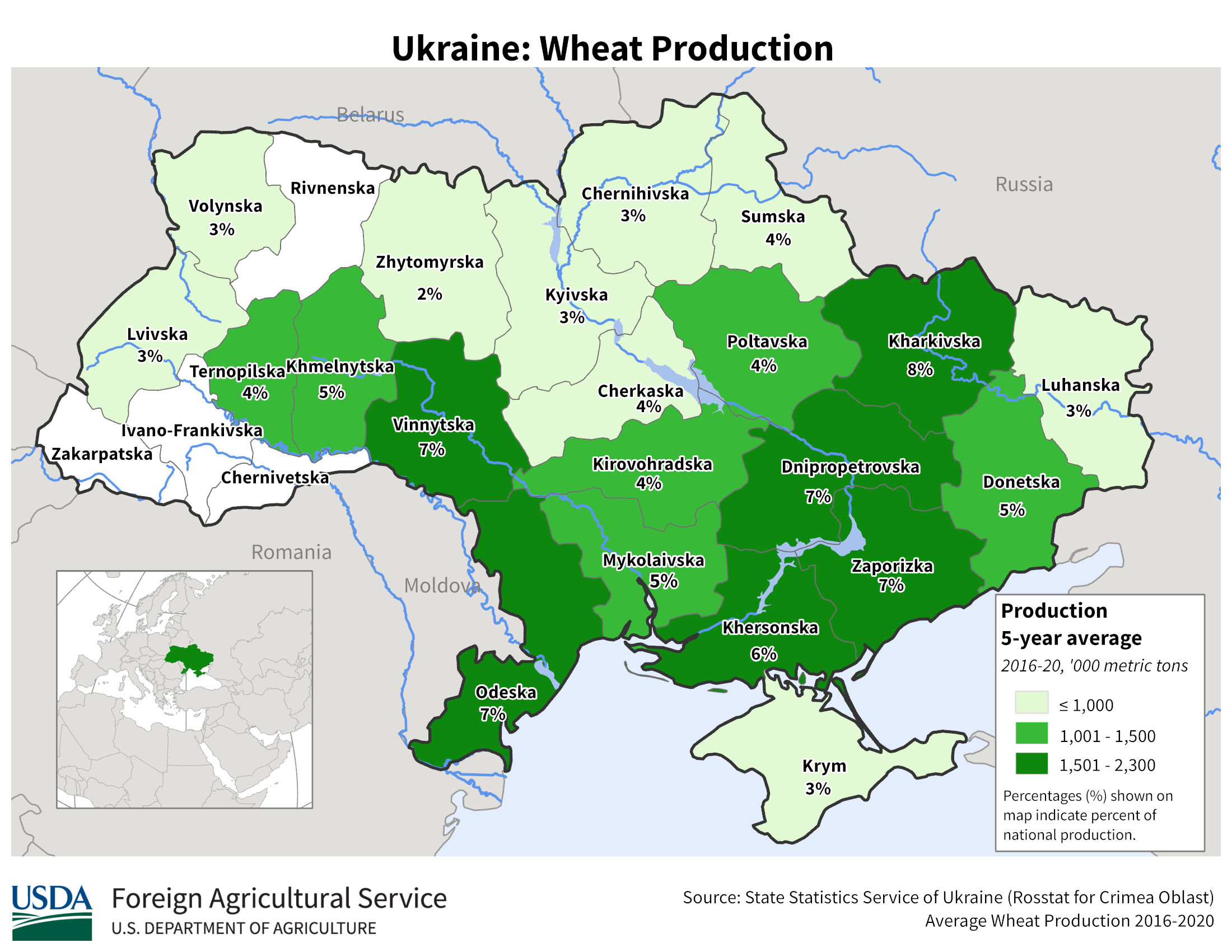

Russia and Ukraine account for more than 28% of world wheat exports, as such developments in the conflict will have large ramifications for prices. Furthermore, Ukrainian crop production (wheat, barley, and sunflowers) is largely focused in the East of Ukraine, the current epicentre of the conflict. The conflict in Ukraine will be the biggest shock to prices, outweighing all other fundamentals. As the conflict in Ukraine continues, the value of commodities has risen considerably. On Monday 7th March UK feed wheat futures (May-22) closed at £303 per tonne, a rise of almost £68 from 23rd February, the day before the invasion began. While prices have risen, daily movements have been volatile.

It is not just wheat, Ukraine and Russia account for 10% of global oilseed production (rapeseed, soybeans, sunflower). The main oilseed grown in the Black Sea region is sunflowers; Ukraine accounts for about 30% of global sunflower seed production with the optimal sowing season about 8-9 weeks from now. If this is compromised, this will have an impact on global vegetable oil prices and in turn rapeseed into the 2022/23 marketing year.

As well as the large rises in output prices as a result of the conflict, input prices are equally inflated. Russia is a key producer of fertiliser and exporter of fuels. The price of fuel is likely to stay inflated with the UK and US governments announcing, on 8th March, their intention to ban Russian oil imports. The UK ban will be phased; Russian supplies of fossil fuels account for 8% of UK imports.