English farmers will be able to take their future BPS payments in a ‘lump sum’ retirement payment this year. Defra has (finally) released its response to the consultation undertaken last year. This was originally expected in the autumn, but has been repeatedly delayed. The response re-affirms the option will be available this spring and sets out the rules in more detail. Precise scheme rules will only be known when the secondary legislation to enact the scheme is passed. But we probably now know enough for sensible business decisions to be made. More details have also been released on the ‘decoupling’ of BPS payments which was consulted on at the same time.

Lump Sum Payments

A summary of the scheme is as follows;

- The Lump Sum scheme will open in April 2022 and run until 30th September 2022. More detail will be provided at this time, including how businesses that have changed through mergers and splits will be treated. It will not be a competitive scheme – anyone who meets the criteria will get the payment. It is envisaged that the Lump Sum is only going to be available in 2022 – if it is not applied for this year, the opportunity will be lost. BPS claimants will be able to request a statement setting out how how much Lump Sum they are eligible for.

- Lump Sum payments would be made in November 2022 (or as soon as the requirements of the scheme on land transfers – see below – have been met).

- To qualify, applicants must have made a BPS claim in May 2018. There will be exemptions for those that have inherited a farm or succeeded to an AHA tenancy since 2018 as well as rules on mergers and splits of businesses between 2018 and now.

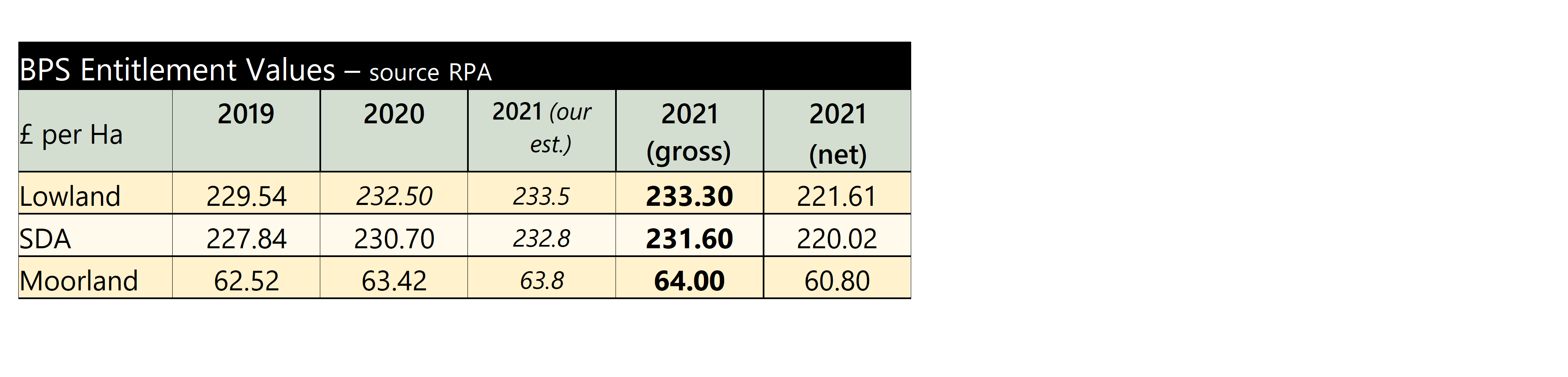

- The payment will be based on the average BPS paid in the three years 2019, 2020 and 2021 (the reference period). The figure for 2021 will be before any Agricultural Transition deductions. This average sets the ‘reference amount’. This will be capped at £42,500 (this is equivalent to around 185 hectares or 460 acres). There will be a standard multiplier of 2.35 to arrive at the value of the lump sum. Therefore the payment will be limited to £100,000.

- If the applicant has already reduced their entitlements compared to the reference period, their lump sum will be reduced proportionally

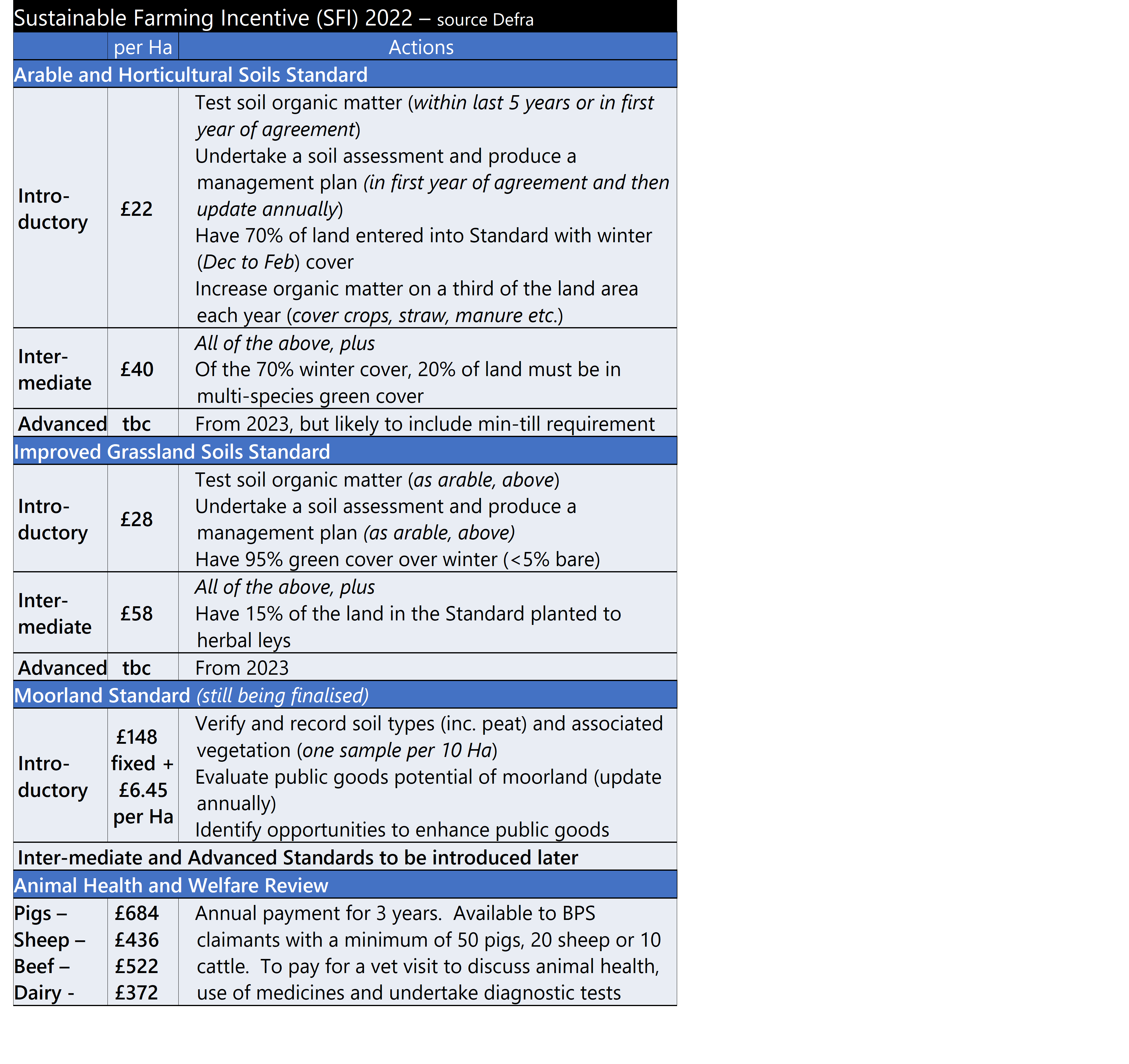

- Those who take up the Lump Sum will not be able to apply for any new agreements under other support schemes such as the SFI or CS. The Lump Sum will need to be paid back if these schemes are entered into.

- Applicants must give up their farmland if they apply to the scheme. They can keep residential and commercial property, non-agricultural land and up to 5 hectares of agricultural land. The land that must be transferred is that which was held on the 17th May 2021. If some of this has already been transferred, the transfer meets scheme rules, and the applicant has kept the entitlements, this would be eligible for the lump sum payment.

- The transfer of land includes sale, granting a tenancy (which must be for more than 5 years), gifting it, or relinquishing a tenancy. Where there is an AHA with succession rights, the transfer to a successor will be eligible for the scheme. It will also be possible to put land held at the 17th May 2021 into woodland planting and claim the Lump Sum. Sole traders will not be able to transfer to a spouse or civil partner.

- Applicants will have until 31st May 2024 to complete their transfer (useful if notices have to be given on tenancies or sales negotiated). It will be possible to apply for the Lump Sum this year and still claim the BPS in 2022 or 2023 if the transfer is not complete. Any BPS payments made in 2022 or 2023 would be deducted from the Lump Sum – it would be treated as a ‘prepayment’ on the Lump Sum.

- The rules on Partnerships and Limited Companies have been made more flexible since the original proposal. Where Partners or Shareholders (either singly or jointly) have at last a 50% interest in a business they will be able to apply for the Lump Sum. All entitlements held by the business would be cancelled. However, any remaining Partners or Shareholders will be able to enter into new land management agreements.

- The tax treatment of the Lump Sum payment has been clarified. Legislation will be introduce to ensure that the payments are treated as capital rather than income. Therefore, they will be taxed under Capital Gains Tax (or Corporation tax for companies) and be eligible for CGT reliefs. This treatment will also apply to any ‘interim’ BPS payments still claimed in 2022 and 2023 whilst the transfer of land is being sorted-out.

To help with ‘generational renewal’, Defra is also planning a New Entrants scheme. More details are promised later in the spring.

De-Linking

As previously outlined, this will not happen until 2024. It appears that a claim (of some sort) will have to be made at May 2023. This might mean some claimants keep hold of the minimum claim area of 5 Ha in 2023 just to preserve the right to De-Linked payments. Defra has announced that the reference period for these payments will be the years 2020, 2021 and 2022 (a different reference period to the Lump Sum). The average of these years will set the reference amount. This amount will be simply multiplied by the annual deduction to get the payment for the years 2024, 2025, 2026 and 2027. It can therefore be seen that, if a farmer made a claim in 2020 and 2021, but has subsequently given up (most of) the land, they will still get two-thirds of the payment relating to that land in the four years from 2024. De-linked payments will be treated as revenue for taxation purposes. Whether delinked payments can be inherited or transferred is not yet known.

With the delinking of payments, entitlements will have no further use – the 2023 year will be the last time they are used. If entitlements have been purchased (or inherited) there may be a loss for Capital Gains Tax after 2023.

Also, the cross-compliance system will come to an end. Defra promises an update shortly on the future regulation of the agricultural sector.

For further information and advice please do not hesitate to contact one of our consultants.