- If you require advice from one of our consultants, do not hesitate to contact them by email or phone. If you do not have their details please contact the office on 01664 503200 or email [email protected]

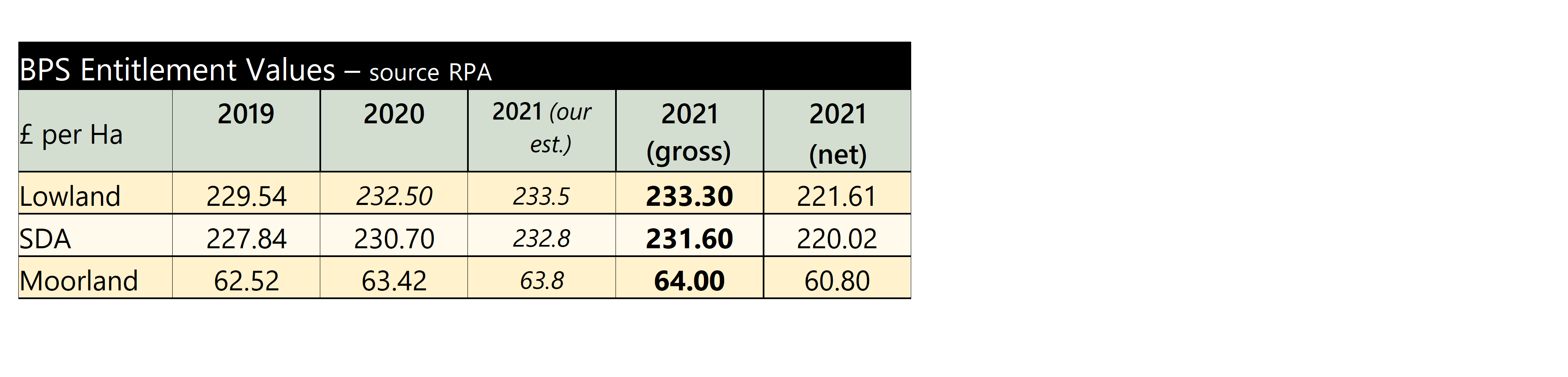

- The English BPS payment rates for 2021 have been published by Defra. The gross rates have increased slightly but the effect of the Agricultural Transition will see farmers receive less than last year. All payments are being reduced by at least 5% (shown in the table below as the ‘net’ figures). Those with a payment over £30,000 will face larger deductions – up to 25% on amounts over £150,000.

- The Welsh Government paid the vast majority of farmers an advance of 70% on their 2021 BPS payments on the 15th October. Around 97% of claimants received the advance. The balancing payments will be sent from the 15th December.

- In the second Budget of 2021, the Chancellor set out the Government’s tax and spending plans with the twin aims of stabilising the Government’s finances post-Covid and promoting the ‘levelling-up agenda’. The latest economic forecasts predict economic growth in 2021 will be 6.5%. Growth in 2022 is put at 6.0% before falling to 2.1% in 2023. The biggest economic issue in 2022 looks set to be inflation. The forecast for CPI is a rate of 2.3% for 2021. For 2022 the OBR has a central forecast of 4% and there is a strong chance it could be as much as 5%. There was relatively little in the budget that directly impacts farming. The rise in the National Living Wage plus the 1.25% supplement on National Insurance will further push up labour costs and the Annual Investment Allowance has been kept at £1m.

- Ahead of COP 26, the UK set out how it will deliver on its commitment to reach net zero emissions by 2050 in its Net Zero Strategy: Build Back Greener. It sets out plans across all sectors of the UK economy. But instead of measures to cut meat and dairy as previously recommended by the Climate Change Committee and the National Food Strategy, the emphasis is on getting farmers to sign up to the new ELM scheme, improve efficiencies in the sector, restore peatlands and increase the planting of woodlands.

- The UK and New Zealand have announced an agreement in principle on a Free Trade Deal (FTA). The deal is similar in nature to the UK-Australia trade deal announced back in June and like the Australian FTA, the UK-NZ FTA is subject to further negotiations on the legal text. Whilst there is an eventual aspiration to fully liberalise agri-food trade, there are adjustment periods for several agri-food products which the UK deems to be sensitive – notably beef, lamb and dairy products.

- It is reported that the fertiliser producer, CF Industries, will continue to operate its plants in the UK after buyers of carbon dioxide (CO2) agreed to pay higher prices. The deal operates until January. This means that ammonium nitrate manufacture will continue for at least the next couple of months (ironically, now as a by-product of CO2 production). Although this eases some of the concerns about availability, fertiliser prices are likely to be high given gas prices.

- What is claimed to be Europe’s largest oat processing facility is being built in the East Midlands. Sited next to Camgrain’s existing store between Corby and Kettering, the plant will supply oat-based ingredients for the food and drink industry. The mill will be run by ‘Navara Oat Milling’, a three-way joint venture between Frontier Agriculture, Camgrain, and Anglia Maltings Holdings (AMH). The plant is due to open in 2023.

- Arable prices are high due to tight markets. The dry conditions experienced by S America last year are continuing and the ongoing La Niña could cause low wheat output from the region again this year. UK wheat production has recovered but with low stocks, domestic supply will be OSR supplies are also very low with prices about £215/t more than a year ago. Only supplies of barley outweigh demand.

- The Welsh Government has launched a consultation on changes on how to identify, register and report livestock movements together with the proposed implementation of Bovine Electronic Identification (EID). Responses to the consultation need to be submitted by 2nd January 2022. The full consultation can be found at https://gov.wales/changes-livestock-identification-registration-and-movement

- The problems in the pig sector remain critical. Prices are falling at a time when costs are soaring. Brexit and Covid have compounded staff shortages, particularly of skilled butchers, which continues to affect throughput in processing plants. Labour issues have seen some processing plants cutting back output by 25% per week since August. The result being pigs remaining on farm, taking up room, and eating expensive feed. The Government appears to have finally recognised the industry has hit a crisis point and, in a move welcomed by the sector, it has announced a support package to include; Private Storage Aid, a Temporary Visa system and a Levy Holiday.

- A reminder that the Future Farm Resilience Fund is now open. If you would like a one-to-one farm resilience review and report carried out by one of our consultants and access to online skills and training, including resilience planning webinars all for free get in touch with one of our consultants. Places are limited. More information can be found at https://www.eventbrite.co.uk/o/ricardo-future-farming-resilience-fund-29430290977

This month’s Spotlight looks at the Animal Health & Welfare Pathway. The first element of this is the Annual Health and Welfare Review which will be available in 2022 and will pay for farmers’ own vets to carry out a yearly Review including diagnostic testing for priority diseases. Click Here for further information.

If you would like more detail on the topics covered above as well as additional articles on UK farm business matters, why not subscribe to Andersons’ AgriBrief Bulletin? Over the course of each month, we give a concise and unbiased commentary on the key issues affecting business performance in the UK agri-food industry, and its implications for farming and food businesses. Please click on the link below for a 90-day free trial: