The Capital Grants scheme in England has been closed. The closure of the scheme was confirmed on the 26th November when a small notice was added to the relevant section of the Defra website stating ‘Capital Grants 2024 are currently closed‘. Subsequently Defra has written a blog (see https://defrafarming.blog.gov.uk/2024/11/27/an-update-on-capital-grants/) in which it says, ‘due to an overwhelming demand for some capital grant items, the main capital grant offer will have closed to new applications – a total of 76 grant items. This is being done to prioritise funds for areas that will have the greatest benefit for food security and nature conservation’. According to Defra, the high demand for some grant items has led to spending levels that ‘aren’t sustainable’ for this year – it is forecast to spend 49% more on capital grants this year than in 2023/24 and 125% more than in 2022/23.

There is no indication when the scheme might reopen, it does talk about being ‘temporarily closed’ to most new applications with a further update in ‘early’ 2025. For those who have already applied and are waiting, it seems they will be put ‘on hold’ for now and applicants will be contacted in early 2025 with information about what happens next.

The following grants remain open;

- Woodland Tree Health Grants

- Capital Grant Plans and Management Plans

- Protection and Infrastructure Grants

- Higher Tier Capital Grants

Further details for these can be found via https://www.gov.uk/government/collections/capital-items-guidance-for-applicants-and-agreement-holders?utm_medium=email&utm_campaign=govuk-notifications-topic&utm_source=571a361e-7871-4f0d-b943-318bffa13b5b&utm_content=daily

If you found this article useful, there are numerous additional articles published each month on our Professional Update bulletin service. You can access a no obligation 90-day free trial via the link below.

Sign up to the Professional Update

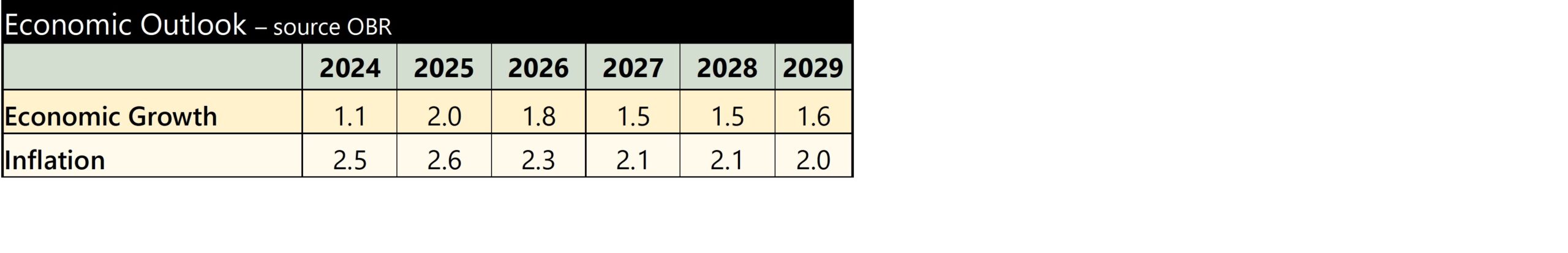

Headline points from the speech include;

Headline points from the speech include;