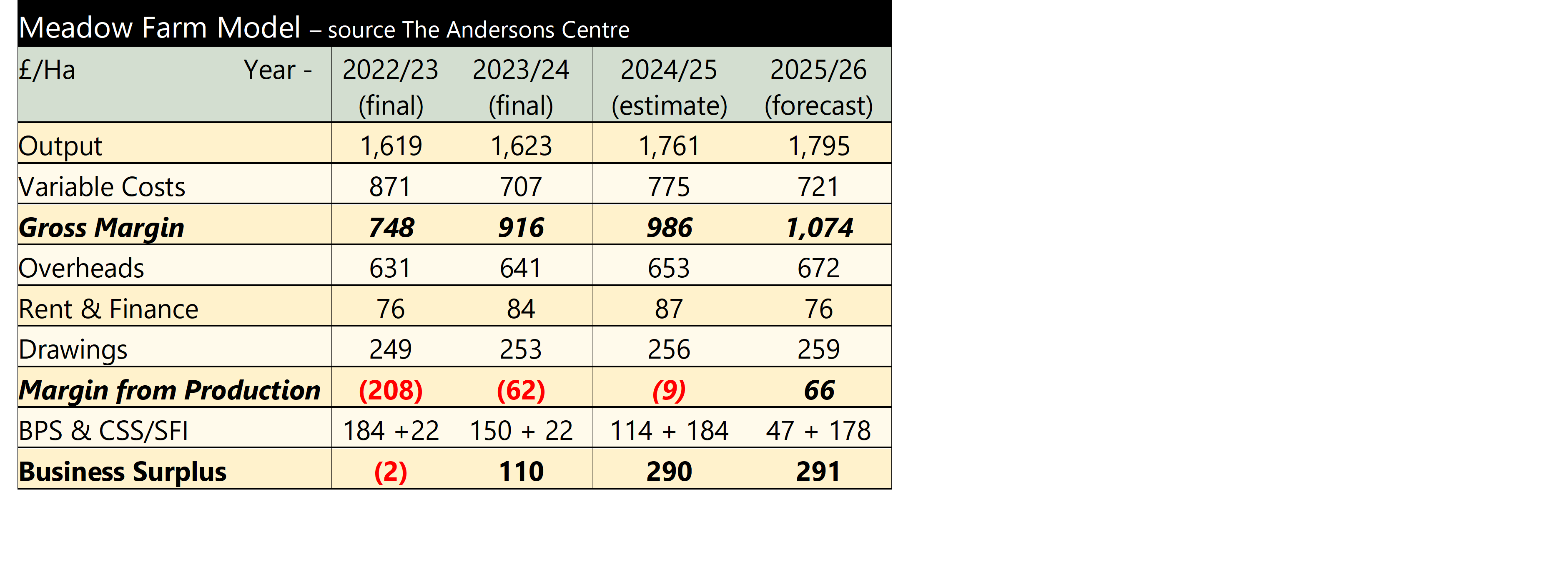

Strong livestock prices and lower feed costs sees Meadow Farm forecast to make a profit from production for only the second time in it’s history in 2025/26. However, its SFI agreement is important in boosting overall farm profitability. Any similar business that has missed-the-boat on the SFI will be in a far less comfortable position.

Meadow Farm is a notional 154-hectare (380 acre) beef and sheep holding in the Midlands. It consists of grassland, with wheat and barley mainly for livestock feed. There are 60 spring-calving suckler cows with all progeny finished, a dairy bull beef enterprise and a 500-ewe breeding flock.

The 2022/23 year was challenging; although output prices had started to rise (particularly for sheep), input costs increased substantially (feed costs were especially expensive). Cuts to the BPS meant the overall farm made a loss. In 2023/24, the gross margin improved due to lower costs and stronger livestock prices. Overhead costs continued to drift upwards. The farm again made a loss from production although it was much lower than the previous year.

The 2024/25 year, just finishing, shows an improvement in output once more. Meadow Farm sells its finished stock in the autumn, so will not have experienced the significant rise in cattle prices since the turn of the year. Some of the higher variable costs are due to the farm entering the SFI (i.e. herbal ley establishment). The extra income from the SFI offsets the decline of the BPS and the business profitability improves.

The 2024/25 year, just finishing, shows an improvement in output once more. Meadow Farm sells its finished stock in the autumn, so will not have experienced the significant rise in cattle prices since the turn of the year. Some of the higher variable costs are due to the farm entering the SFI (i.e. herbal ley establishment). The extra income from the SFI offsets the decline of the BPS and the business profitability improves.

Farmgate cattle prices are exceptionally high currently. Even using a ‘conservative’ budgeting price compared to the current high prices, for the 2025/26 year about to commence, Meadow Farm is budgeted to make a margin from production. This is for only the second time (previously in 2021/2022). However, a (bigger) reduction in the BPS, sees business surplus, similar to the year just finishing.

This farm entered the SFI (2023 version) this time last year. However, we have modelled an alternative scenario where the farm’s CS agreement carried on until the end of 2024. This meant it was still working-up its SFI application when the scheme closed on 11th March. In this situation, Meadow Farm would be looking at a Business Surplus of just £113 per Ha. Also, it is not clear what opportunities, if any, may be there in the future for farms like this to enter into environmental agreements. There is a clear split between the ‘haves’ and ‘have-nots’ when it comes to the SFI.

If you found this article useful, there are numerous additional articles published each month on our Professional Update bulletin service. You can access a no obligation 90-day free trial via the link below.

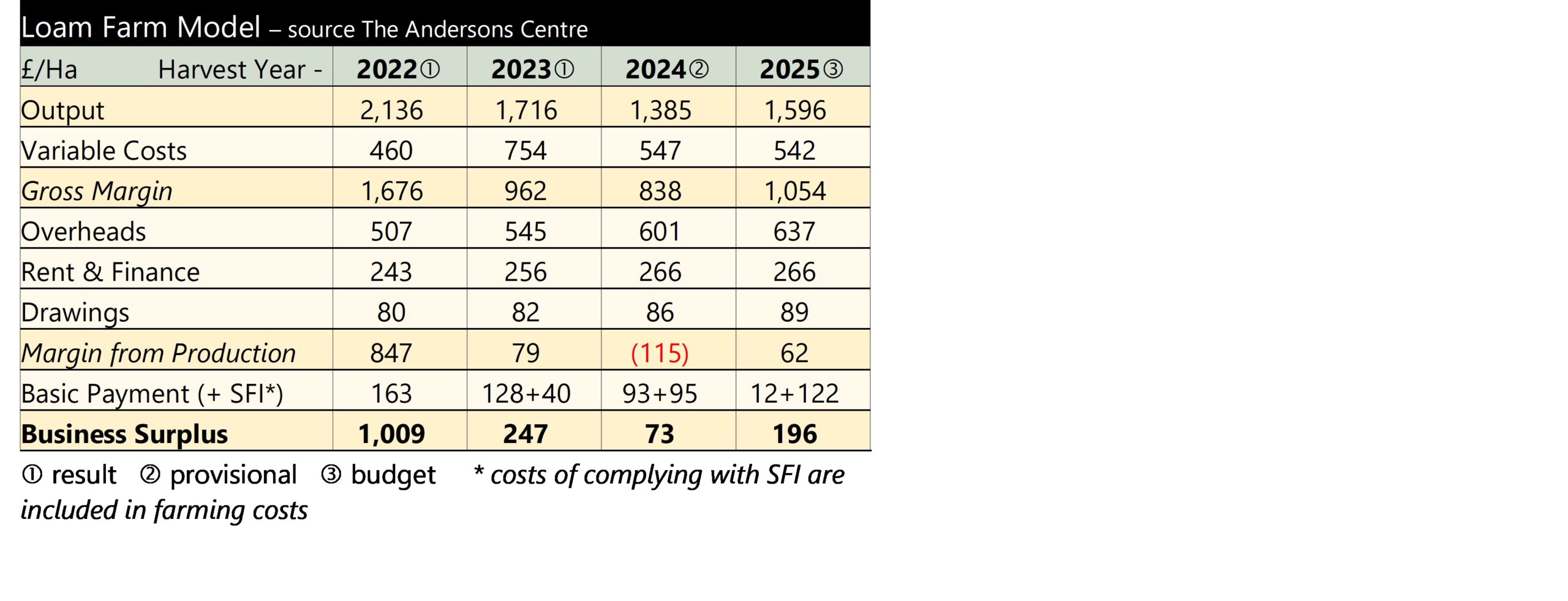

The farm is completing its grain sales from harvest 2024. It has less to sell than average due to reduced yields – a result of the wet weather through the autumn of 2023 and spring of 2024. Coupled with unexciting prices this means the output of the farm is reduced – some 35% on the 2022 harvest year – although it must be noted that this was an unusually good year. Although variable costs have fallen, overheads have climbed. This has resulted in a loss from production. This year’s residual Basic Payment and the SFI the farm has entered offset this shortfall, but there is a low level of overall farm profitability.

The farm is completing its grain sales from harvest 2024. It has less to sell than average due to reduced yields – a result of the wet weather through the autumn of 2023 and spring of 2024. Coupled with unexciting prices this means the output of the farm is reduced – some 35% on the 2022 harvest year – although it must be noted that this was an unusually good year. Although variable costs have fallen, overheads have climbed. This has resulted in a loss from production. This year’s residual Basic Payment and the SFI the farm has entered offset this shortfall, but there is a low level of overall farm profitability.

Headline points from the speech include;

Headline points from the speech include;