The Animal and Plant Health Agency (APHA) has provided an update on the progress being made in the development of a cattle bovine TB vaccine. According to the Agency Phase 1 and Phase 2 are now complete, but an additional Phase 3 is due to commence on commercial cattle which should be completed in 2026.

Phase 1 focused on testing the performance and safety of the DIVA skin test. DIVA is an acronym for Detect Infected among Vaccinated Animals and this was an important first step to ensure the test could accurately identify animals that were truly infected with bTB or just protected by the vaccine. Phase 2 evaluated the safety of the cattle BCG vaccine and how well the DIVA skin test worked in vaccinated cattle. This provided data on how the vaccine and test perform in real-world conditions. The results from these trials are being used to support applications for Marketing Authorisations.

Phase 3 is an additional phase, taken by the GB administrations to allow APHA to gather ‘additional data’ on the DIVA skin tests performance. Phase 3 will take place on commercial cattle across England and Wales involving at least 10 farms and 750 animals. APHA says it is continuing to ‘work at pace’ but will only deploy the vaccine and companion DIVA skin test when it has all the right steps in place. However, the Agency does not give a timescale of when this might be, saying the aim is to deliver an efective cattle TB vaccination strategy within the ‘next few years’.

This update follows the Government’s announcement in August saying that it has started work on co-designing a comprehensive new bovine TB Strategy for England. To ensure the new Strategy is using the latest scientific and practical evidence since 2018, Professor Godfray has updated the evidence base for TB control. The full report, Godfray bTB Evidence Review Update 2025 can be found at https://assets.publishing.service.gov.uk/media/68d563169ce370a7e0a0fcfe/Godfray_bTB_Evidence_Review_Update_2025.pdf . The new draft TB Strategy for England is expected to be published in Spring 2026. Bovine TB remains one of the most challenging animal health issues facing livestock farmers in the UK. However, the Government is moving away from widespread badger culling, instead, it is expanding badger vaccination and continuing to develop the cattle vaccine. The goal remains to achieve Officially TB Free Status for England by 2038.

If you found this article useful, there are numerous additional articles published each month on our Professional Update bulletin service. You can access a no obligation 90-day free trial via the link below.

Sign up to the Professional Update

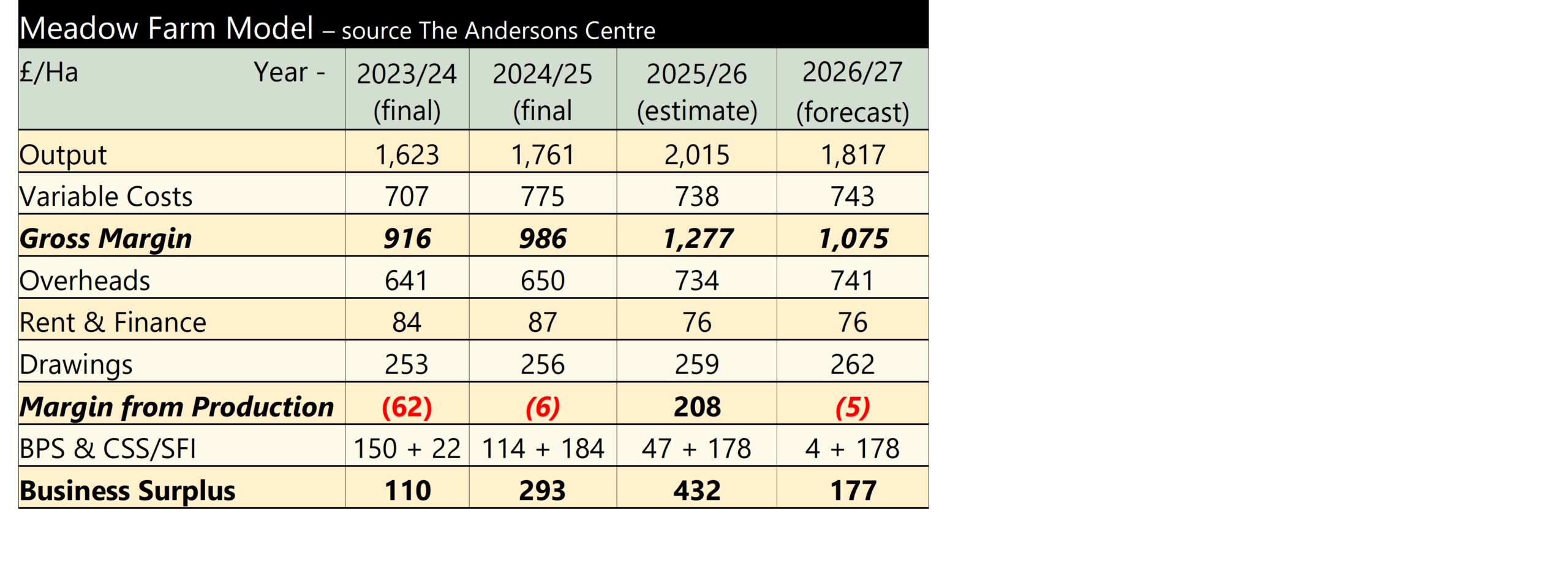

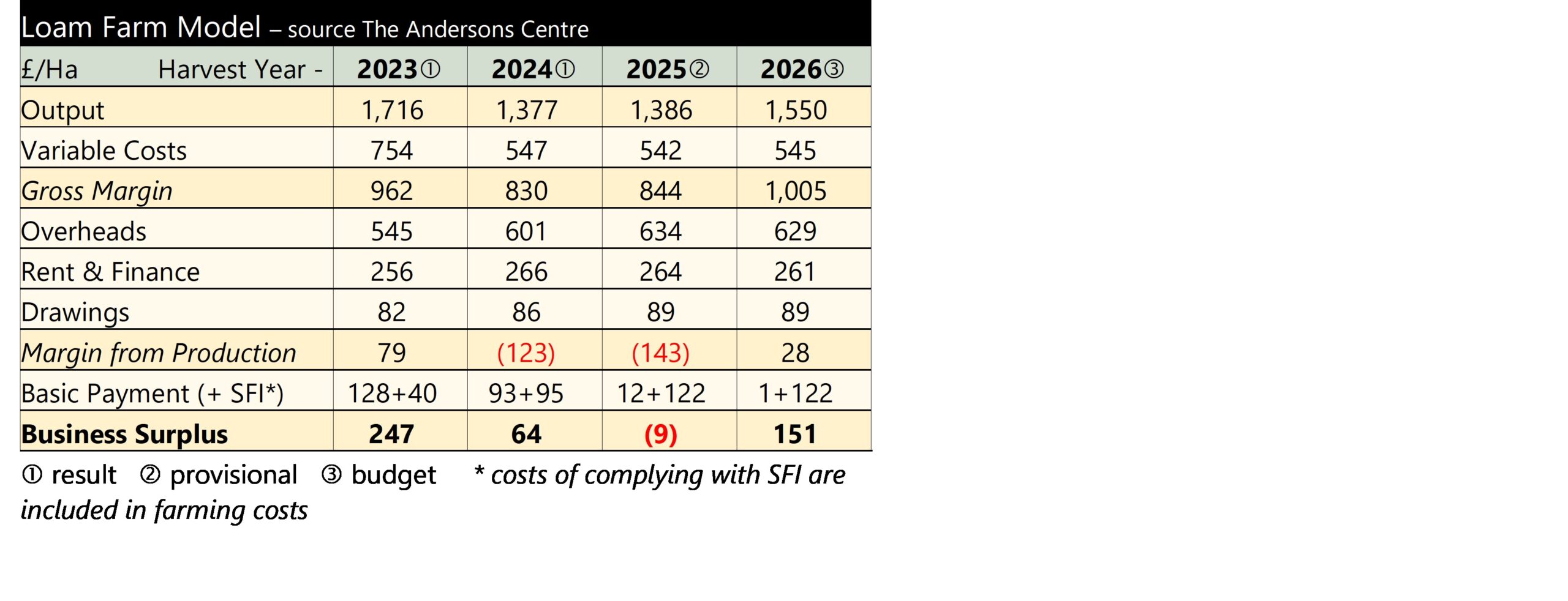

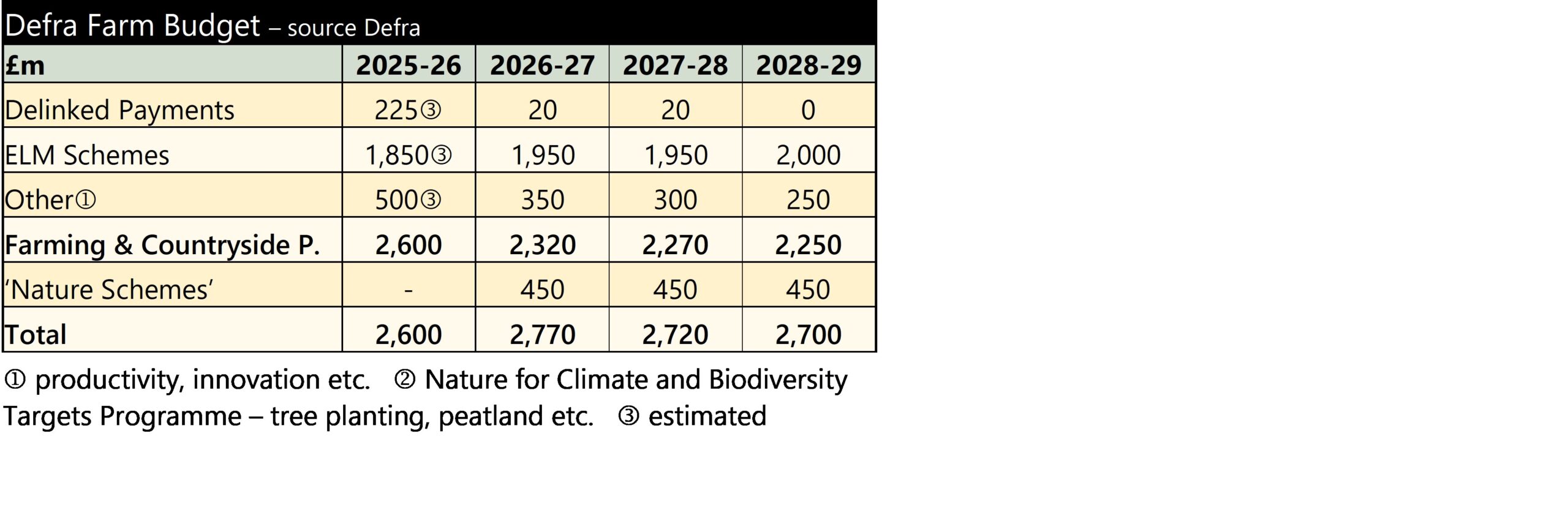

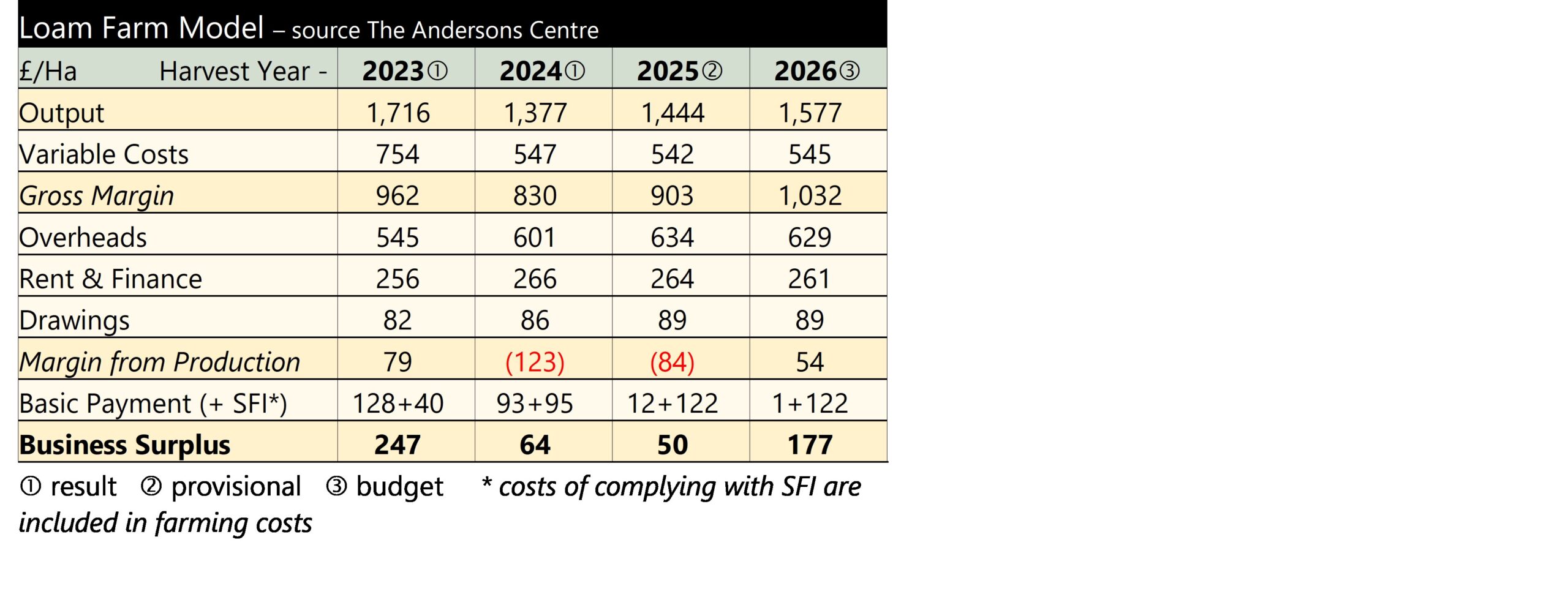

The 2023 year was reasonable – although it looked poor at the time, in comparison with the two spectacular years that preceded it. Harvest 2024 suffered from the very wet autumn 2023 through into spring 2024 reducing yields. Grain prices were also lower than in the previous year. This meant the farm made a loss from production last year and required the BPS and SFI to bring it back into surplus. For the current year the weather has presented the opposite problem – it has been too dry through the spring. This is forecast to result in yields again being lower than the farm’s average. Prices have not improved since last year either. It can also be seen that overhead cost continue to push up. Overall, the Margin from Production is still negative, although slightly better than last year. However, there has been a big drop in the BPS with the maximum £7,200 being received in 2025 equating to just £12 per Ha on Loam Farm. SFI payments have increased a little as the farm ‘upgraded’ its agreement by going for some extra SFI 2024 options. The overall Business Surplus is set to be lower than last year.

The 2023 year was reasonable – although it looked poor at the time, in comparison with the two spectacular years that preceded it. Harvest 2024 suffered from the very wet autumn 2023 through into spring 2024 reducing yields. Grain prices were also lower than in the previous year. This meant the farm made a loss from production last year and required the BPS and SFI to bring it back into surplus. For the current year the weather has presented the opposite problem – it has been too dry through the spring. This is forecast to result in yields again being lower than the farm’s average. Prices have not improved since last year either. It can also be seen that overhead cost continue to push up. Overall, the Margin from Production is still negative, although slightly better than last year. However, there has been a big drop in the BPS with the maximum £7,200 being received in 2025 equating to just £12 per Ha on Loam Farm. SFI payments have increased a little as the farm ‘upgraded’ its agreement by going for some extra SFI 2024 options. The overall Business Surplus is set to be lower than last year.