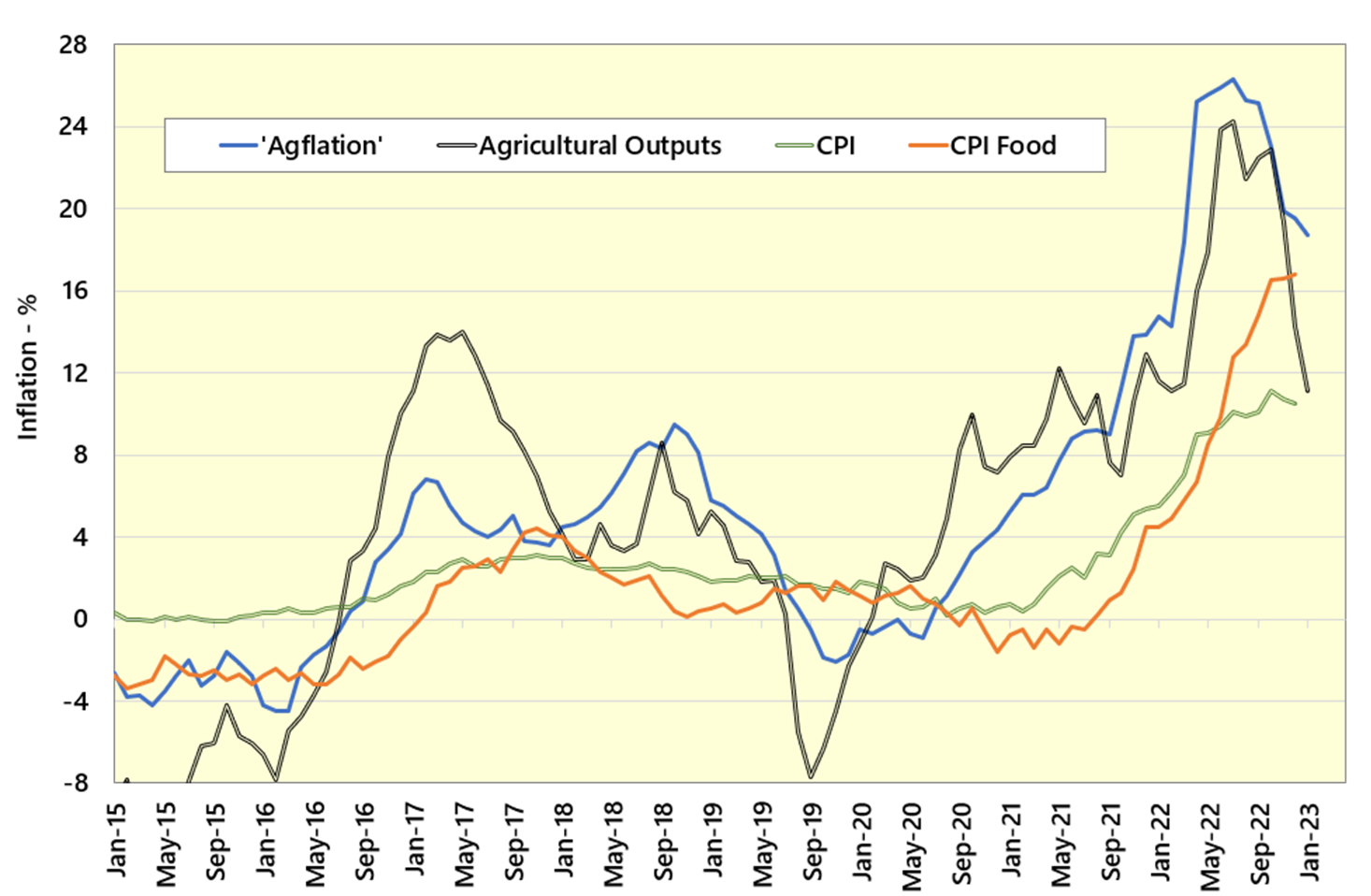

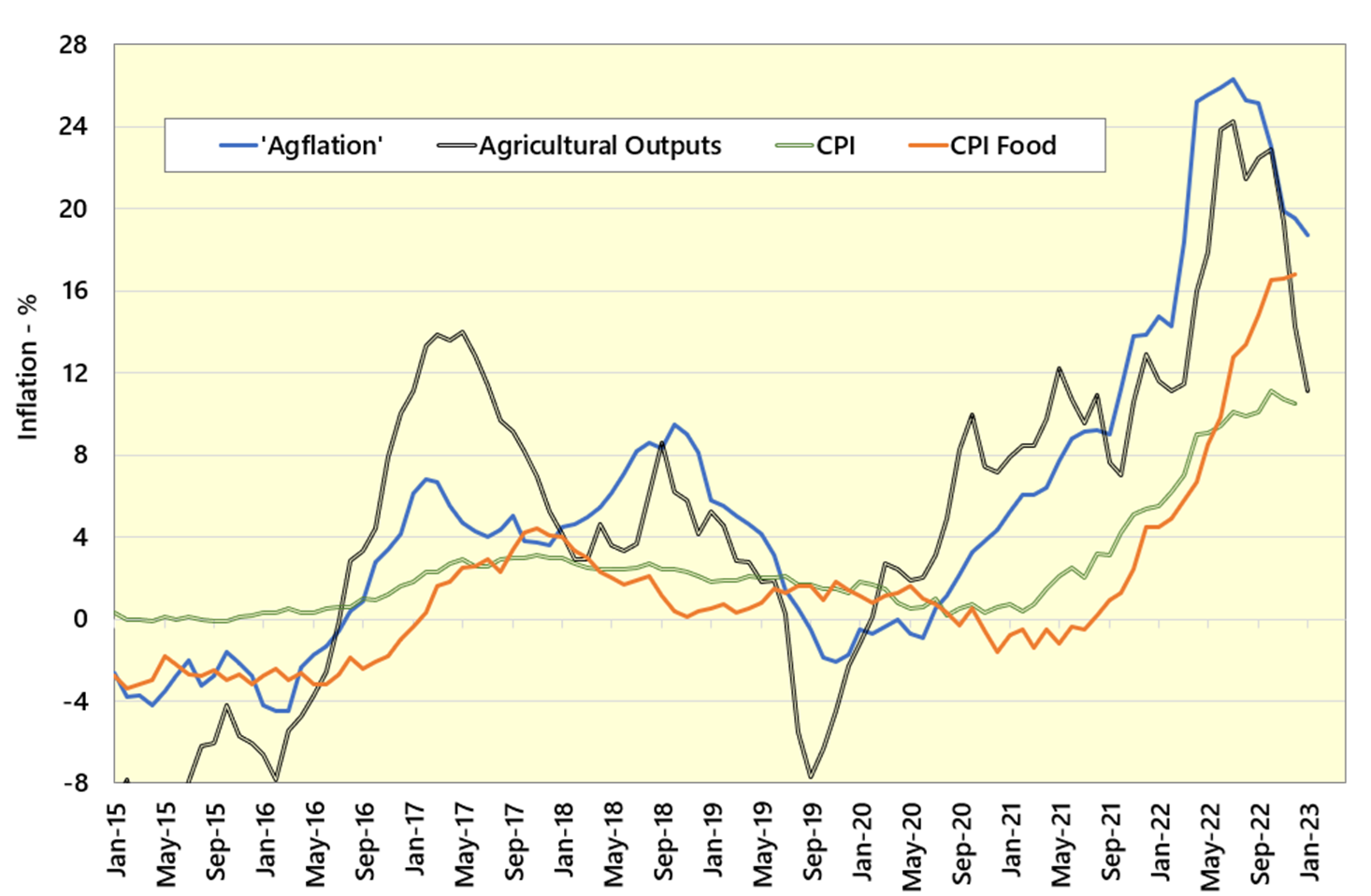

Agricultural inputs’ inflation (Agflation) continues to outpace general economic inflation (CPI) as well as agricultural outputs and food prices (denoted by CPI Food). This is the key finding of Andersons’ Agflation estimates for January. The latest estimates put Agflation at 18.7% annually, significantly ahead of agricultural outputs (11.1%). Although the CPI and CPI Food indices continue to rise, currently standing at 10.5% and 16.8% respectively, there is still a gap between the food price inflation that consumers face and the increased input costs that farmers must manage. Therefore, UK agriculture continues to experience a cost of farming squeeze.

Andersons ‘Agflation’ and UK Consumer Prices Index (CPI) – 2015 to 2023

Sources: ONS, Defra and Andersons

Notes: Andersons’ Agflation index builds upon on Defra price indices for agricultural inputs and weights each input cost (e.g., animal feed) by the overall spend by UK farmers. Andersons then provides a more up-to-date estimate of the price index for each input cost category. The Agricultural Outputs index is compiled in a similar manner. Defra price indices for agricultural outputs are weighted based on their overall contribution to UK farming output. Andersons then provides more recent estimates for each output category, with the index being updated as the official Defra data becomes available.

* represents the % change versus the same month a year earlier.

Although Agflation remains higher than food prices, it is declining. In July 2022, it peaked at 26.3%. That said, throughout 2022, agricultural input cost inflation generally surpassed price rises for agricultural outputs. The only exception came in October and November when both indices were aligned. During December and January, the agricultural outputs’ inflation rate has more than halved, declining from 22.9% in October to 11.1% today. It is now 7.6 percentage points lower than agricultural inputs’ inflation.

This signifies a challenging period ahead for farmers as the gap between input cost rises on the one hand and output prices on the other continues to widen. Global Dairy Trade (DGT) auction prices, taken as a proxy for global milk prices, have declined by 6% in the past month. Feed wheat prices (£213/t) are also down by 6% versus December and are returning to levels seen this time last year when prices stood at £210/t. The implications of these trends will require careful consideration.

Whilst general economic inflation looks to have peaked and several commentators are forecasting that the inflation rate will decline significantly during 2023, food prices continue to rise. This should not come as a surprise at this juncture because there tends to be a lag between the rates of inflation for agricultural commodities (inputs and outputs) and the inflation rate for food prices. In the past year or so, this has been in the region of 6 months. With agricultural inflation peaking in July, one would anticipate that the CPI Food index will also peak shortly, if it has not already done so.

Inflation and the impact of the ‘cost-of-living crisis’ on UK agriculture will be key themes during the forthcoming Andersons’ Spring Seminars on the Prospects for UK Agriculture which will be taking place across 11 UK venues from 24th February. The Seminars will examine UK farming’s profitability and performance, upcoming farm policy changes, trade, inflation and the impact of the cost-of-living crisis. They also provide sector-by-sector analysis and profitability outlook for the farming industry. Andersons’ Seminars have been running for 26 years and are renowned across Britain for informing agri-food professionals on how the industry is set to evolve in the next year and beyond, and the implications thereof for organisations serving the sector.

Despite the inflationary pressures that UK farming is facing, we have held the cost of the seminars at the same level as last year. Furthermore, if you book online via you will receive, via e-mail, a bonus complimentary copy of our most recent Professional Update bulletin (worth £50). More information including booking details is available via: https://www.theandersonscentre.co.uk/seminars

Ends.

Notes:

No. of Words: 658

Authors: Michael Haverty and Richard King

Date: 31st January 2023

This news release has been sent from The Andersons Centre, 3rd Floor, The Tower, Pera Office Park, Melton Mowbray, Leicestershire LE13 0PB. For further information please contact Michael Haverty on +44 (0)7900 907 902 or Richard King via +44 (0)7977 191427.