Following the recent Budget, UK farming faces three significant challenges: changes to Inheritance Tax (IHT), adjustments to support payments, and increased employment costs. These shifts could alter the sector’s landscape, impacting both individual farming businesses and the overall structure of UK agriculture.

1. Inheritance Tax Changes

One of the headline announcements from the Budget is the alteration of Inheritance Tax relief, with a new £1 million cap on the value of combined agricultural and business assets qualifying for full relief. This decision has sparked considerable discontent within the industry, particularly among family-owned farms. While the reform is projected to generate only modest revenue for the Treasury, it appears to be based on a misunderstanding of what a true family farm looks like, and it could seriously affect the ability of many farming families to sustain their businesses through succession.

That said, from an industry-wide perspective, the direct impact of these changes may be more contained. Farmland is likely to remain within agricultural use, even if ownership changes hands. When farms face the pressure of “death duties,” neighbouring farms may expand their holdings, allowing more successful farming businesses to grow sustainably. Similarly, if a farmer with 200 acres gives up, then his or her neighbour with 500 acres is likely to want to take it over to make their business more sustainable. Or two neighbours having an extra 100 acres each. The key point from a macroeconomic perspective is that all the land is still farmed.

Furthermore, it could also be argued that, on average, it might be farmed ‘better’ as the more successful businesses will be the ones that grow. Notably, none of the businesses in the example would be large – all are likely to be ‘family farms’. Therefore, this does not necessarily drive the growth of large ‘corporate’ farms. So, this is a huge issue for individual farming families, but far less so in terms of food output.

2. Adjustments to Support

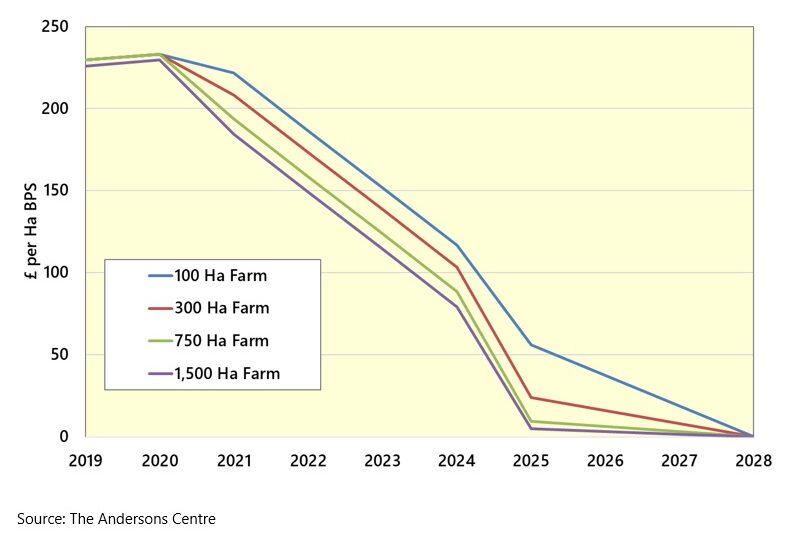

Budgetary decisions related to agricultural support are also expected to challenge profitability at the individual farm level. While the support budget for next year remains nominally the same, inflation erodes its real value, and an effective cap on Basic Payment Scheme (BPS) payments at £7,200 in 2025 adds further pressure. For farms heavily reliant on support, this change may necessitate difficult decisions, either by adapting operations or exiting the sector. However, land that becomes available will likely be acquired by other producers, maintaining overall farming activity.

Therefore, the overall size of the farming sector (if measured by food output) probably will not change much. Whilst there will be some land lost to development and environmental management most farmland will still be farmed (by someone). It’s who’s doing the farming that will change. We are likely to see accelerated structural change in the sector over the next 5-10 years through a combination of support changes, tax changes and generational change. Essentially, there will be an increase in the number of farmers who stop farming each year. This will essentially be the sum of all the individual decisions made by every farm in the UK. And each farm will have unique circumstances.

Changing BPS Support by Farm Size – 2019 to 2028 – £ per Hectare

3. Rising Employment Costs

The most immediate consequence of the Budget comes from the increase in the National Living Wage and employers’ National Insurance contributions. This measure directly affects production costs across all sectors, with labour-intensive segments of agriculture feeling the strain acutely. Without corresponding increases in output prices, certain farms may find production unsustainable, as seen in the egg sector in recent years. Moreover, the shift in support towards environmental objectives reduces the financial buffer for struggling production sectors, increasing the likelihood of some enterprises ceasing operations due to lack of profitability.

Looking Ahead – How Andersons can Support Your Business

As these Budget changes take effect, UK agriculture faces a period of adjustment, with individual farms forced to make tough choices. In the short term, production costs remain the most pressing concern, while structural shifts due to IHT and support adjustments will drive longer-term changes in the sector’s composition.

For those with further questions or who are seeking tailored support to navigate these new challenges, please contact us via [email protected]. Our team are highly experienced in helping farming families to navigate through difficult business challenges and we’re happy to help you to understand the impacts and explore strategic options for your business.

For those who do business with farmers and require a deeper analysis of how the structure of the UK farming industry is likely to evolve over the long term, our recently published Farmer Numbers report will contain highly useful insights. This report provides a detailed analysis of how farm business numbers across a range of UK and Irish agricultural sectors are likely to evolve to 2040. More detail is available via: https://theandersonscentre.co.uk/farmer-numbers/