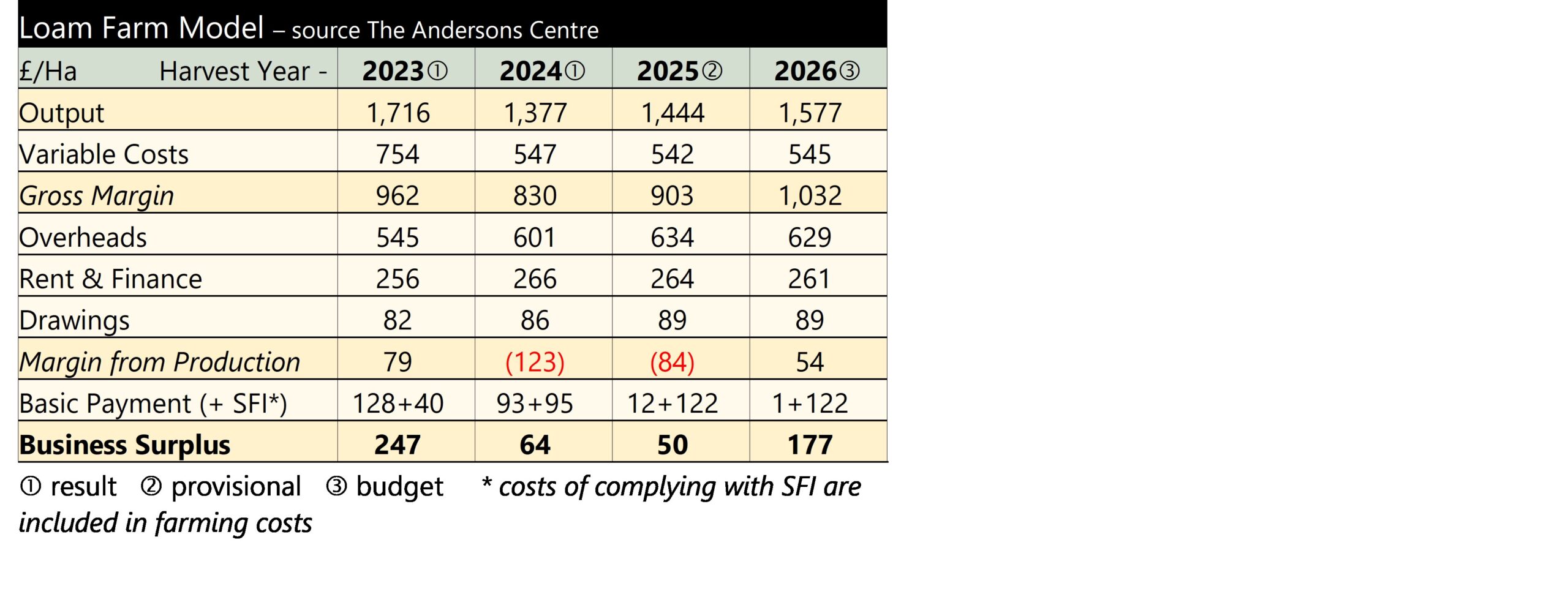

With harvest fast approaching for many, and already started for some, we have updated the figures for our Loam Farm model. This shows that the 2025 crop is likely to deliver another lacklustre set of returns on cereals farms.

The table below summarises the last two harvests and the one upcoming. We have also added a new budget for the 2026 harvest year. To recap, Loam Farm is a notional 600 hectare business that has been used since 1991 to track the fortunes of British combineable cropping farms. It is based on real-life data. It is partly owned and partly rented, has a working proprietor plus one full time member of staff and harvest casual. It grows wheat, oats, beans and barley and has a SFI agreement (2024 version).

The 2023 year was reasonable – although it looked poor at the time, in comparison with the two spectacular years that preceded it. Harvest 2024 suffered from the very wet autumn 2023 through into spring 2024 reducing yields. Grain prices were also lower than in the previous year. This meant the farm made a loss from production last year and required the BPS and SFI to bring it back into surplus. For the current year the weather has presented the opposite problem – it has been too dry through the spring. This is forecast to result in yields again being lower than the farm’s average. Prices have not improved since last year either. It can also be seen that overhead cost continue to push up. Overall, the Margin from Production is still negative, although slightly better than last year. However, there has been a big drop in the BPS with the maximum £7,200 being received in 2025 equating to just £12 per Ha on Loam Farm. SFI payments have increased a little as the farm ‘upgraded’ its agreement by going for some extra SFI 2024 options. The overall Business Surplus is set to be lower than last year.

The 2023 year was reasonable – although it looked poor at the time, in comparison with the two spectacular years that preceded it. Harvest 2024 suffered from the very wet autumn 2023 through into spring 2024 reducing yields. Grain prices were also lower than in the previous year. This meant the farm made a loss from production last year and required the BPS and SFI to bring it back into surplus. For the current year the weather has presented the opposite problem – it has been too dry through the spring. This is forecast to result in yields again being lower than the farm’s average. Prices have not improved since last year either. It can also be seen that overhead cost continue to push up. Overall, the Margin from Production is still negative, although slightly better than last year. However, there has been a big drop in the BPS with the maximum £7,200 being received in 2025 equating to just £12 per Ha on Loam Farm. SFI payments have increased a little as the farm ‘upgraded’ its agreement by going for some extra SFI 2024 options. The overall Business Surplus is set to be lower than last year.

Farmers generally think ‘next harvest will be better’. This may be true. We cannot know the weather for next season, but a ‘reversion to the average’ sees output increase. Variable costs are quite stable. After two poor years the farm is cutting back slightly on investment which helps keep overheads in check by reducing depreciation. However, the farm is budgeting £25,000 on drainage works to address some of the issues highlighted in the past couple of seasons. The Margin from Production at least ends up as a positive. It can be seen that the BPS for 2026 is down at £1 per Ha. This follows Defra’s announcement that the maximum payment will be £600 per business in 2026 and 2027. The overall Business Surplus improves but is still below the long-term average for this model farm.

If you found this article useful, there are numerous additional articles published each month on our Professional Update bulletin service. You can access a no obligation 90-day free trial via the link below.

Sign up to the Professional Update