The 2024 harvest year continues to be challenging for cereals farmers. Whilst dryer weather has allowed some spring operations to progress, the wet weather since the autumn has already affected the likely financial returns for the coming harvest.

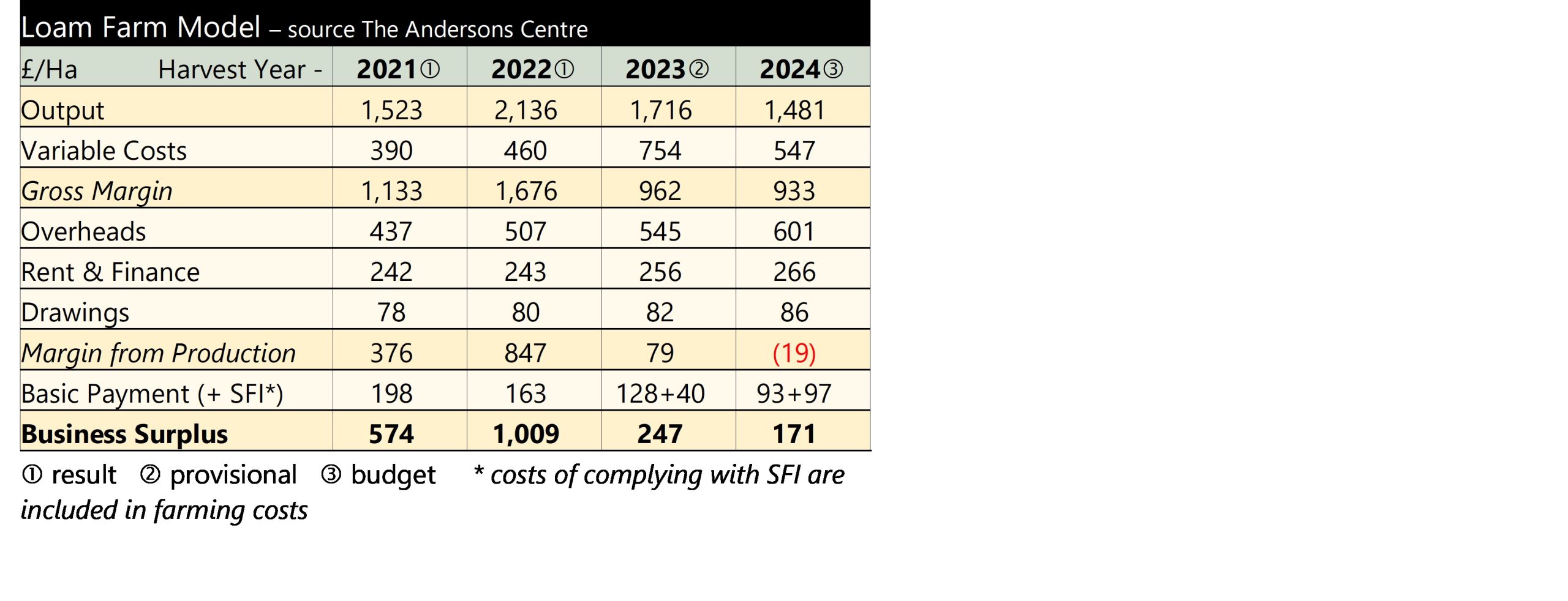

In light of these difficulties we have updated our Loam Farm Model. Loam Farm is a notional 600 hectare business that has been used since 1991 to track the fortunes of British combinable cropping farms. It is partly owned and partly rented and is based on real-life data. It has one full-time worker and employs harvest casual labour.

The farm has just finished its sales from harvest 2023. It can be seen that the returns have been far lower than the previous 2021 and 2022 harvests. However, those two were unusually good (some of the best profits Loam Farm has seen in 30+ years). The results for harvest 2023 are far more in line with historical averages. However, even with the farm making a profit, the business is under some cashflow pressure due to higher working capital requirements and the need to pay tax on the profits from the two previous good years.

For harvest 2024, variable costs have reduced – mainly lower fertiliser values. Overheads increase due to labour, machinery, fuel and general overhead cost inflation. Some costs have increased to deliver the SFI options that the farm has signed-up for. The key issue for the coming harvest is output though. Despite the reduced UK harvest crop prices are un-exciting for growers – largely due to plentiful grain stocks around the world. Yields are also forecast to be lower. Loam Farm is assumed to have established its winter crops, but the forecast yield has been reduced due to crop stress over winter and the significant bare patches in fields. The farm has around a third spring cropping. Again, these crops are assumed to have been established but the expected yield has been cut due to the late planting and unfavourable soil conditions. It can be seen that, for Loam Farm, this means there is a forecast loss from production for this harvest. The (declining) BPS and SFI are required to bring the business back into profit.

For harvest 2024, variable costs have reduced – mainly lower fertiliser values. Overheads increase due to labour, machinery, fuel and general overhead cost inflation. Some costs have increased to deliver the SFI options that the farm has signed-up for. The key issue for the coming harvest is output though. Despite the reduced UK harvest crop prices are un-exciting for growers – largely due to plentiful grain stocks around the world. Yields are also forecast to be lower. Loam Farm is assumed to have established its winter crops, but the forecast yield has been reduced due to crop stress over winter and the significant bare patches in fields. The farm has around a third spring cropping. Again, these crops are assumed to have been established but the expected yield has been cut due to the late planting and unfavourable soil conditions. It can be seen that, for Loam Farm, this means there is a forecast loss from production for this harvest. The (declining) BPS and SFI are required to bring the business back into profit.

If you would like more detail on the topics covered above as well as additional articles on UK farm business matters, why not subscribe to our Professional Update bulletin? Over the course of each month, we give a concise and unbiased commentary on the key issues affecting business performance in the UK agri-food industry, and its implications for farming and food businesses. Please click on the link below for a 90-day free trial.

Sign up to the Professional Update